Section 301 tariffs on imported solar polysilicon and wafers were increased to 50%.

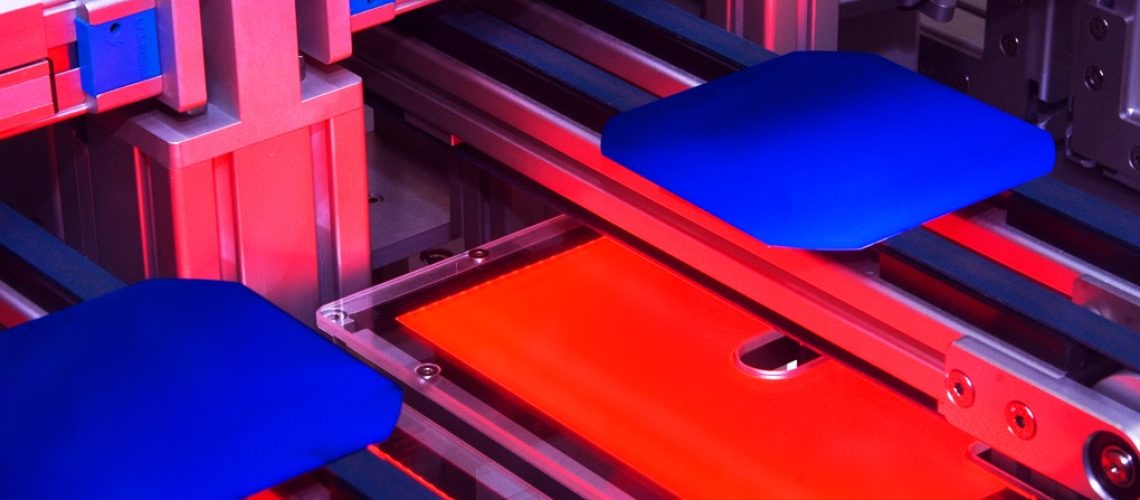

The solar panel supply chain begins with mining and refining raw polysilicon, forming it into ingots, slicing it into wafers, manufacturing it into cells, and then assembling the cells into a frame, making a solar module.

The U.S. Trade Representative office has announced that early legs of the solar supply chain–polysilicon and wafers–will now be subject to a 50% tariff if imported from China. This doubles the previous tariff rate on polysilicon, and places wafers on the Section 301 tariff list for the first time.

This move by the Biden administration to extend tariffs on China builds on a May 2024 decision to double solar cell tariffs from 25% to 50%.

Section 301 tariffs were first introduced by the Trump administration in 2018 and have been increased under the Biden administration.

“The tariff increase will protect against China’s policy-driven overcapacity that depresses prices and inhibits the development of solar capacity outside of China,” the White House said in a statement. “China has used unfair practices to dominate upwards of 80 to 90% of certain parts of the global solar supply chain and is trying to maintain that status quo.”

Mike Carr, executive director of the Solar Energy Manufacturers for America (SEMA) Coalition said, “It is an important precedent that a 50% tariff will soon cover the whole solar module supply chain in China.”

A note from Phil Shen, managing director, Roth Capital Partners said that the application of tariffs to solar wafers, previously not included in Section 301, might cause an unintended consequence of making it more difficult to set up solar manufacturing in the United States. The note said that increased wafer prices from China is a negative for businesses looking to develop U.S.-based solar cell factories.

“No one imports wafers from China currently for use in a U.S. cell fab, but new U.S. cell fabs will need to do that unless or until ingoting and wafering capacity gets built outside China,” a D.C. lawyer told Roth.

However, setting up robust polysilicon, ingot, and wafering outside of China may prove difficult. In 2022, China achieved an 89% global share of solar-grade polysilicon and has only expanded since. In 2024, global oversupply has caused crashing prices, leading to China’s top four polysilicon producers to report financial losses in the first half of the year.

The federal notice for the Section 301 tariff increase can be read here.