During pv magazine USA Week, Crux co-founder and CEO, Alfred Johnson shared insights on the accelerating multi-hundred-billion-dollar transferable tax credit market.

During pv magazine USA Week, Alfred Johnson, CEO and co-founder of Crux, described the tax credits within the Inflation Reduction Act, the largest climate law ever passed.

The IRA creates a new multi-hundred-billion-dollar market for transferable tax credits, intended to accelerate the growth of clean energy and decarbonization projects. The IRA includes the ability for companies that make different products to take advantage of the tax credits. The new transferability mechanism enables developers to sell federal clean energy tax credits to third-party buys who have tax liability. Prior to the IRA, the only way for developers to monetize tax credits was through expensive, complex tax equity transactions, which had limited participation. Now corporate buyers can integrate transferable tax credits into broader tax planning strategies.

Transferability basics

The IRS established two types of transferable tax credits. One is the Section 48 investment tax credit that are generated when projects are placed into service. The other is the Section 45 production tax credit, which is determined by the amount of energy or components produced. Buyers or partnerships that are independent of the credit-generating projects may purchase the tax credits, and Johnson pointed out that buyers range from Fortune 500 companies to smaller corporate entities. To claim credits by filing a transfer election statement, with a few additional considerations that apply such as the fact that the trax credits can only be sold once.

Crux is a sustainable finance technology company that assists with financing clean energy and decarbonization projects, starting with transferable tax credits. The company has had $19 billion worth of credits listed on Crux as of August 2024 with the fastest deal closing in 17 days. The company has seen more than $16 billion bids in 2024. Overall Crux estimates that the market completed between $16 and $18.5 billion in transfer deals and expects the market to reach $22 billion to $25 billion in total tax credit monetization in 2024.

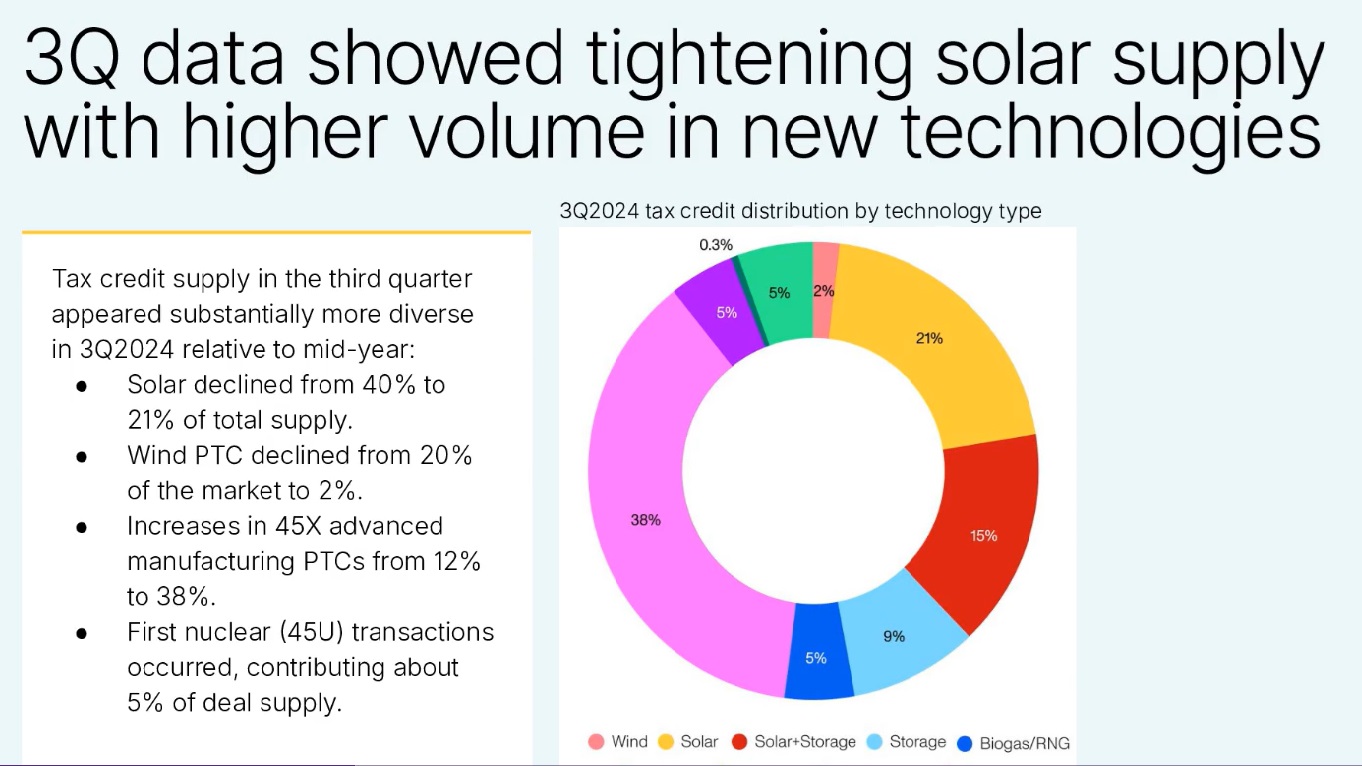

Johnson noted that solar is the largest category of transferable tax credits, representing as much as 40% of supply in 2024. The category includes everything from residential portfolios to utility-scale projects. He noted that pricing is improving, generally maxing out around $0.94. And while the supply of large-scale solar investment tax credits became limited, interest increased in smaller, distributed generation projects or portfolios of residential, commercial and industrial or community solar projects.

Looking ahead, Crux expects demand to remain “robust” for deals of all sizes but especially for larger deals, with credits receiving an average of two to four bids per listing. Johnson concluded that it is still a seller’s market, with demand outpacing supply. As a result of this demand, the credit sale is a highly competitive process.

Popular content