A Q3 market insight report update from Anza shows solar module prices have increased roughly 10% from their all-time lows.

Marketplace operator Anza released its Q3 solar module pricing insights report, highlighting market price averages for the distributed generation space. Distributed generation (DG) includes residential, commercial, industrial, and community-scale projects, excluding utility-scale projects. The data represents median DG list prices from the more than 35 module vendors participating in the Anza platform.

In its Q2 report, Anza said solar module prices had formed a floor for the first time in two years, and early signs of price increases were suggested. The company attributed price increases to the antidumping and countervailing duty (AD/CVD) petition to module imports from Southeast Asia.

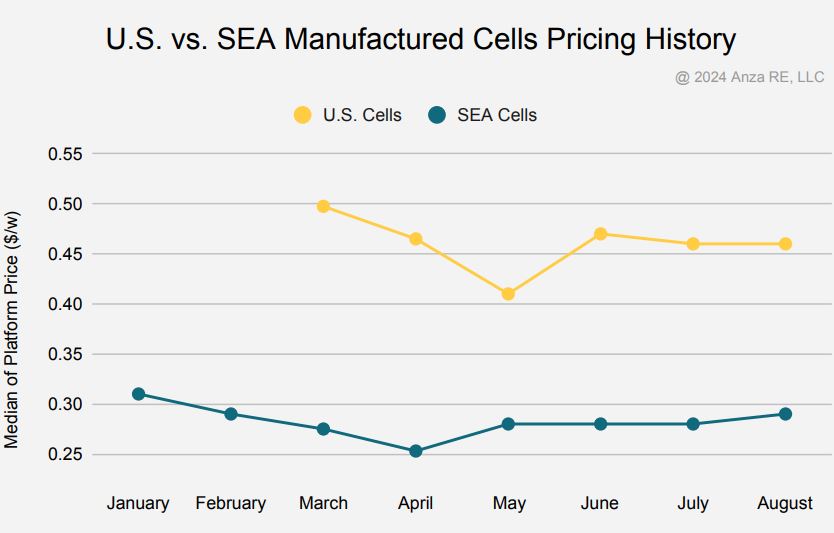

Now, in its Q3 report with data through August, the bounce up off of bottom-floor pricing has been confirmed. From April’s low to the Q2 high in June 2024, the median U.S. module price rose from $0.25 cents per watt to $0.275 cents per watt, marking a 10% increase. Prices have declined slightly since June, resulting in an 8.8% increase from April through August, with prices standing at roughly $0.27 per watt.

Anza said AD/CVD enforcement and the removal of bifacial solar modules from Section 201 tariff exemption have pushed prices higher.

“The AD/CVD petition has driven up module prices for Southeast Asian manufacturers due to increased capital expenditures and supply chain adjustments, but not all suppliers have been equally impacted,” said the report. “Some manufacturers, outside the scope of the current investigation, have quickly adapted their supply chains and maintained competitive, fixed pricing, even compared to pre-AD/CVD levels.”

Anza noted that pricing from Southeast Asian module suppliers increased about 15% from April lows to August 2024. It noted that tariff-exempt suppliers are also raising prices alongside these suppliers, while remaining price-competitive.

The report noted that the acceleration of U.S. solar manufacturing is beginning to reshape the market. Demand for U.S. components in clean energy projects has increased under the Inflation Reduction Act of 2022, which offers a tax credit bonus covering 10% of installed costs for projects that achieve a certain threshold of domestic content.

“This shift has increased U.S.-based production capacity as manufacturers rush to meet rising demand for domestically produced solar components,” said Anza. “Highlighting that change, we saw a reduction of 4 cents from March to August 2024 or a 7.5% decrease caused by the added competition among U.S. manufacturers.”

Popular content