NextEra’s Q2 2024 quarterly earnings report shows significant growth in the company’s renewable pipeline. However, the group, which is typically exacting, refused to put a hard number on their future demand growth expectations.

There has been considerable discussion recently about the growth in power grid demand in the United States, following roughly two decades of relatively minimal growth. This anticipated increase in demand is largely driven by electricity-hungry artificial intelligence chips. The conversation about the resources required to power these data warehouses varies by region; in the southeast U.S., it primarily centers around new methane facilities, whereas Texas is focused on expanding solar, wind, and battery storage, supplemented by substantial existing gas resources. In contrast, California is actively pursuing new clean energy deals.

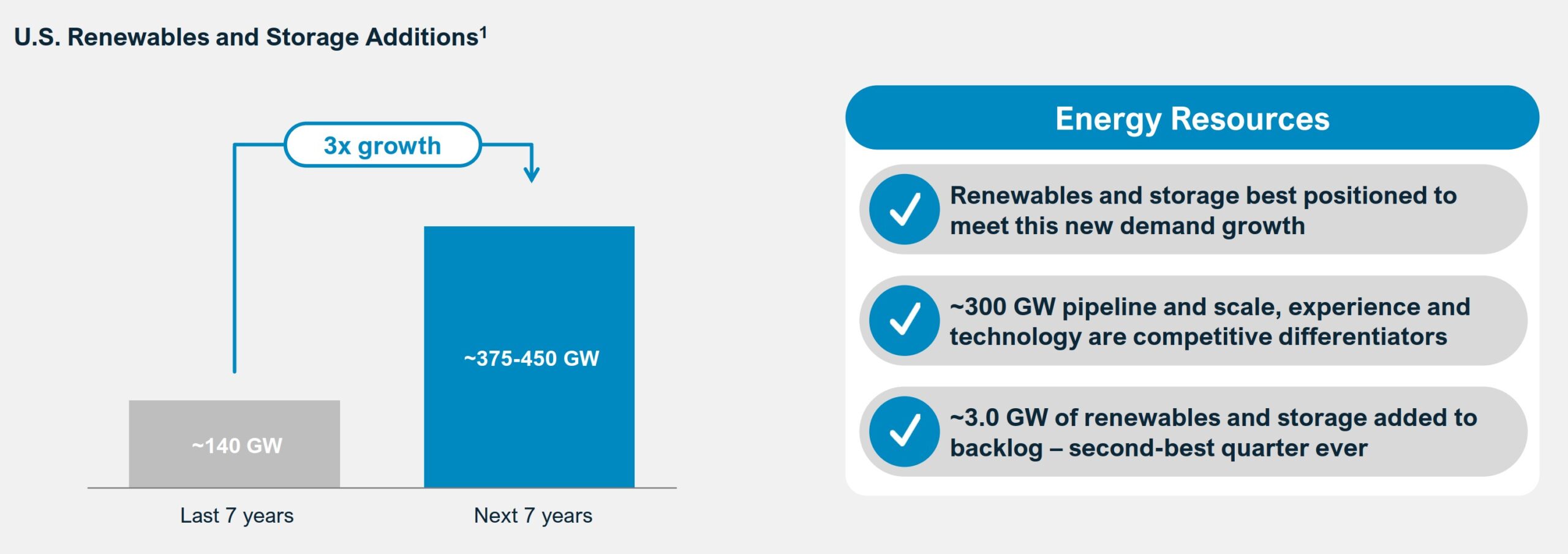

In NextEra’s second-quarter earnings call, the company reported its second-best renewable energy origination quarter ever, with the addition of more than 3 GW of renewables and storage projects to their project backlog. When including wind repowering alongside new wind, solar, and storage projects, the company expects to deploy between 36.5 and 46.5 GW of new capacity from 2024 to 2027.

As the nation’s largest clean energy developer, NextEra generates revenue from methane, pipelines, wind, solar, storage, nuclear, and coal, with approximately half of their revenue coming from fossil fuels. However, the company’s strategic discussions indicate a shift towards prioritizing solar plus storage over methane for future generation leadership.

John Ketchum, the company’s President and CEO, stated:

This marks our second best origination quarter ever. These results support our belief that the bulk of the growth demand will be met by a combination of renewables and battery storage…we also are well aware of the realities of new build gas-fired generation, it’s more expensive in most states, is subject to fuel price volatility and takes considerable time to deploy given the need to get gas delivered to the generating unit and the three to four year waiting period for gas turbines.

The company, known for its meticulous attention to detail and a dedicated mathematics department, has been reluctant to provide specific growth projections. Some analysts believe that the actual increase in electricity demand will be much less pronounced than what headlines may imply. The ambiguous statements from NextEra may also indicate that the company anticipates more moderate growth rates.

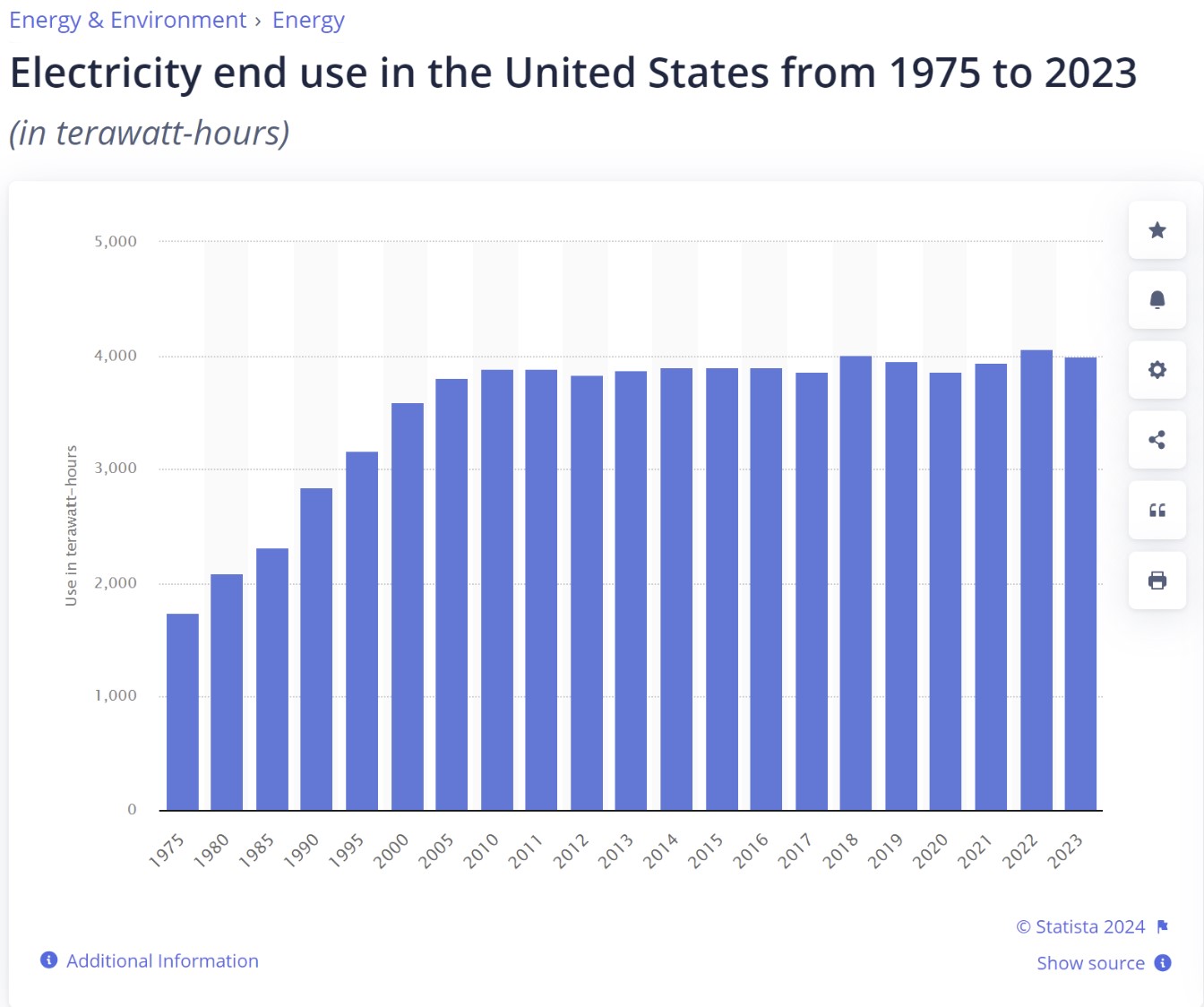

For example, instead of specifying the anticipated growth, the company stated, “NextEra expects power demand to grow four times faster over the next decades compared to the prior 20 years.” This statement raises questions, particularly regarding the company’s definition of “next decades” and the baseline of minimal demand growth over the past two decades.

Source: Statista

Regarding the total renewables to be deployed, NextEra is a bit more exacting, and optimistic. The company highlighted the U.S. Energy Information Administration’s projections, which suggest that renewable and storage additions will deploy three times faster in the next seven years compared to the previous seven. Additionally, NextEra noted that their overall project pipeline has reached 300 GW of capacity, representing a 20% increase over last year’s figure of 250 GW.

The company expects to deploy 7.1 GW of solar power in 2024-2025, followed by an additional 6.1 GW in 2026-2027. Over a third of this capacity will be deployed in the southeast, with Florida driving much of that growth. The Midwest region will represent nearly another third of the solar deployment capacity during the same period.

Popular content