Basis Climate has delivered an investment tax credit (ITC) transfer worth $600,000 for a 1.2 MW solar project, complete with a twelve-page transfer agreement plus requisite due diligence documentation. This transaction, facilitated under the new provisions of the Inflation Reduction Act (IRA), signals a significant shift in the tax credit landscape, expanding access to smaller-scale solar projects.

Tax equity, a financing arrangement where investors fund solar power projects in exchange for federal tax benefits like investment tax credits, is a complex field that integrates capital and labor. Initial costs for assembling these deals can start under $100,000 but may quickly escalate to millions. These expenses, covering fees for lawyers, accountants, and engineers, support extensive review of data rooms and the drafting of extensive contracts, focusing on compliance and diligence. The objective is to ensure that large investment groups can safely deploy billions of dollars in compliance with the U.S. Internal Revenue Service regulations.

The introduction of the IRA brings about ITC transferability. This mechanism provides a less formal alternative to traditional tax equity, facilitating the use of solar ITCs by investors.

When pv magazine USA consulted tax equity professionals, now also working with transfers, at the Solar Energy Industries Association’s annual Finance, Tax, and Buyer’s Seminar in March about the potential for simpler “six- to eight-page” tax transfer contracts, their response was a mix of skepticism and amusement. Such brief documents would stand in stark contrast to the extensive documentation required for solar tax equity transactions due to their complexity and regulatory demands. Our sources indicate that shorter contract lengths would align better with those used in the movie industry, which also navigates its own tax credit processes.

In the past, even the smallest projects that attracted tax equity investors required $1 to $2 million in tax benefits to offset the $75,000 in fees. That landscape is now evolving.

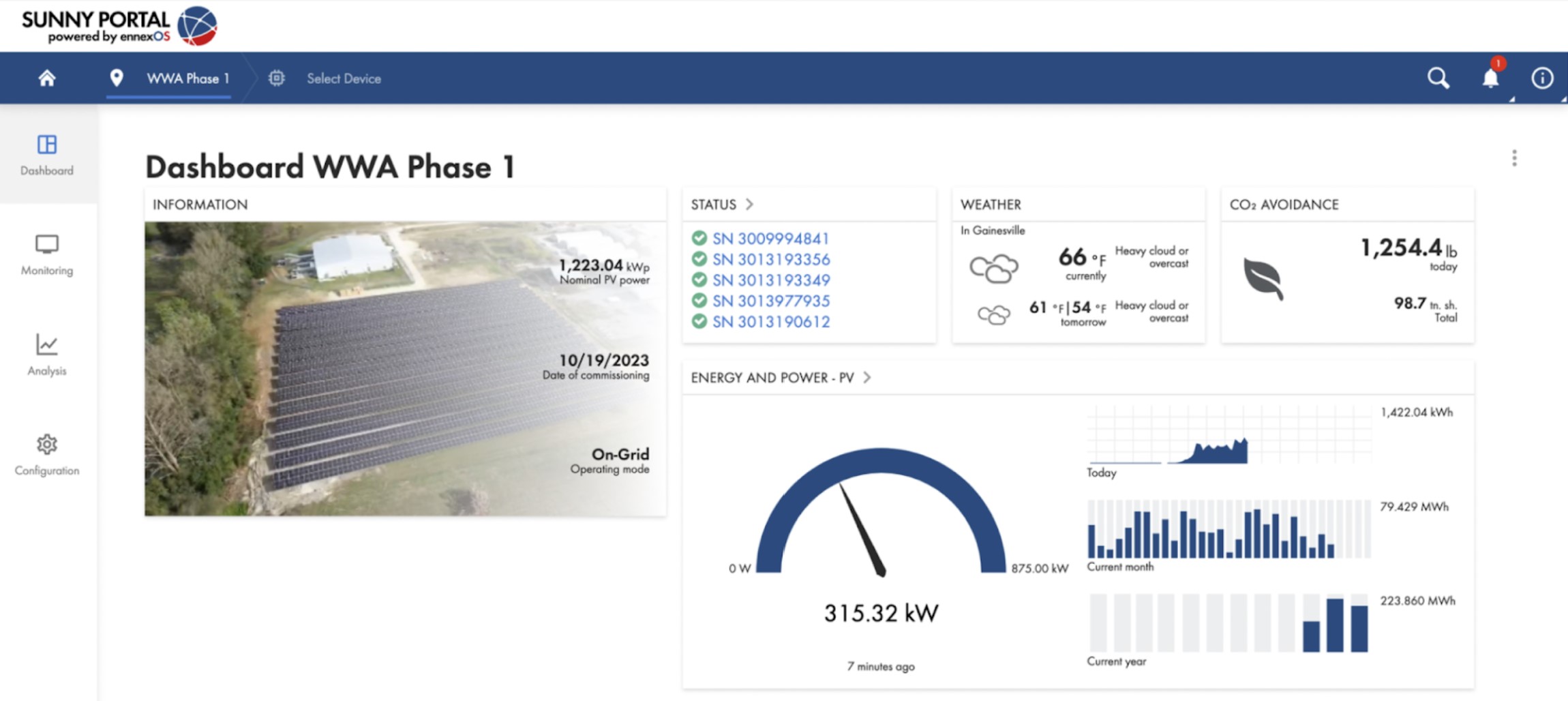

Source: Basis Climate’s online portal

Basis Climate, an internet-based tax credit transfer platform, has closed nearly $250 million in deals and boasts a $2 billion pipeline across various technologies, including solar, energy storage, renewable natural gas, wind, and electric vehicle charging. Over the past month, the company has managed over $50 million in term sheets and offers, with more than $70 million in signed deals progressing towards closure.

Basis Climate’s $600,000 ITC project partnered with WeWould Solar, a single-purpose entity providing ancillary power to on-site agricultural processing in Gainesville, Florida. The project is for a net-metered, behind-the-meter solar power initiative within the utility region managed by the Clay Electric Cooperative. The transaction took place through Basis Climate’s website, with the ITC being acquired by Creditable Capital.

Derek Silverman, co-founder & chief product officer at Basis Climate, shared insights with pv magazine USA.

The project is slated for development in three phases, each anticipated to be 1.2 MW. Notably, since the initial phase was under 1 MWac, it was exempt from prevailing wage or apprenticeship requirements. The installation will use SMA Sunny High Power PEAK3 inverters, Canadian Solar bifacial BiHiKu 425 W modules, and TerraSmart’s Glade Wave racking.

Source: WeWouldSolar energy monitoring dashboard

Creditable has disclosed that it is underwriting ITC transfer transactions targeting a 10% to 15% return on investment, net of fees and expenses, for its investors. For a $600,000 transaction, with limited information available, a return in this range suggests that Creditable Capital paid approximately 85 to 87 cents on the dollar. This payment rate is at the lower end of the typical industry range, where 90 to 95 cents on the dollar is common for larger solar power projects involving investment-grade asset owners and sophisticated development and construction firms.

First Solar, meanwhile, received 97 cents on the dollar when it sold its manufacturing tax credits.

Risk management

Silverman highlighted that the project’s diligence covered approximately 20 key areas, including organizational documents, project design, construction plans, operational strategies, insurance placement, and project valuation and qualification. Finalizing these core areas early helped Creditable Capital concentrate on higher-risk aspects, such as determining the project’s eligible basis and mitigating recapture risks, which involve the risk of having to return tax benefits if the project fails to comply with regulatory requirements.

For projects where asset owners lack strong financial foundations, buyers commonly secure tax insurance to safeguard against recapture risk. This insurance also provides a financial safety net, known as a backstop indemnity, in case the project’s liabilities exceed its assets. In the case of Creditable, the financial guarantees provided by the asset owner were sufficient, eliminating the need for tax insurance. However, when sellers lack a robust balance sheet, buyers generally obtain tax insurance to ensure comprehensive protection.

Adam Stern, founding partner of Creditable Capital, commented on their funding strategy, stating:

Creditable is getting more comfortable with the funding at a point in time after diligence is completed with a holdback for the IRS registration. Creditable, through its investors and financial institution relationships, is working to provide bridge loans on projects that it is buying the credits for.

A lingering risk in these transactions is how the IRS will require buyers and sellers to verify aspects of the deal, such as the determination of the basis.

Determining the appropriate ITC is a complex process due to the US Internal Revenue Service’s (IRS) detailed and evolving definitions of what constitutes an eligible project ‘basis’. For example, essential infrastructure like fences and roads, required by code for project deployment, are not considered part of the eligible basis, thus not qualifying for the 30% ITC. Similarly, interconnection costs had been excluded until recent changes under the IRA, which now allows projects under 5 MWac to include these costs in their ITC calculations.

In the traditional tax equity market, buyers of ITC needed to demonstrate significant involvement in the solar projects, taking on considerable operational and developmental risks, and ensuring long-term revenue from the projects flowed to them through complex financing arrangements. Some of requirements have been relaxed, although thorough due diligence and responsible investment practices remain essential.

A community solar project developed by Wunder Power in Maryland, part of an ITC sale facilitated by Basis in 2023. Image: Basis Climate.