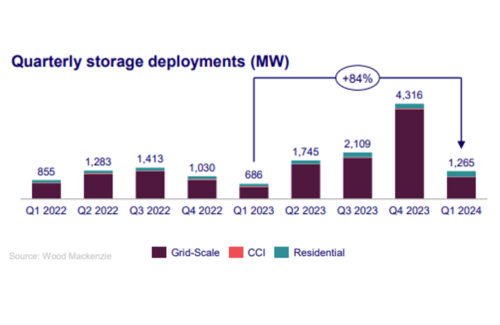

The U.S. energy storage market set a first-quarter record for capacity installed in Q1 2024, with 1,265 MW deployed across all segments. This marks the highest storage capacity ever installed in a first quarter in the United States, representing an 84% increase from Q1 2023.

According to Wood Mackenzie and the American Clean Power Association’s (ACP) newly released “US Energy Storage Monitor” report, the grid-scale segment installed 993 MW, producing the highest Q1 on record for the grid-scale segment. Nevada, California and Texas accounted for 90% of new grid-scale capacity added.

“The rapid growth of the energy storage industry comes at a critical time, providing a solution to growing energy demand and increasingly variable weather conditions that are placing added stress on the grid,” said John Hensley, Vice President of Markets and Policy Analysis at ACP. “A strong start to 2024 sets expectations high for the remainder of the year. We look forward to celebrating the industry’s first double digit installation year and cheering the tight race for top storage state playing out between California and Texas.”

“The rapid growth of the energy storage industry comes at a critical time, providing a solution to growing energy demand and increasingly variable weather conditions that are placing added stress on the grid,” said John Hensley, Vice President of Markets and Policy Analysis at ACP. “A strong start to 2024 sets expectations high for the remainder of the year. We look forward to celebrating the industry’s first double digit installation year and cheering the tight race for top storage state playing out between California and Texas.”

The residential segment set a record for quarterly installations at 250 MW in Q1, an 8% increase over the previous record set in Q4 2023. California drove growth in the residential segment, installing 24% more than the previous quarter. California also led the community, commercial and industrial (CCI) segment to install 19.4 MW, which represents a 43% decline quarter-on-quarter (QoQ), as both New York and Massachusetts experienced one of the slowest CCI quarters in recent years.

Despite seasonal patterns of project installations resulting in a QoQ drop, Q1 installation additions of 993 MW in the grid-scale segment represent a 101% increase over Q1 2023. The grid-scale segment is forecasted to end 2024 with 11.1 GW installed, a 45% increase year-over-year. Texas will overtake California of new capacity installed (in megawatt-terms) this year as price volatility continues to grow under both, expanding renewables and load growth in the less regulated market.

50-MW energy storage system on the Golden Triangle II project in Mississippi. Credit: Origis Energy

The residential segment also grew, with California tripling its number of installations for residential energy storage between Q1 2023 and Q1 2024. With Q1 attachment rates at 46%, there is still room for growth. Nationally, high interest rates continue to affect the residential segment, increasing the share of third-party ownership installations.

The CCI segment had a down quarter. CCI storage deployments in California have remained stagnant as the majority of systems being interconnected continue to fall under NEM 2.0. Deployments are expected to rise as the full effects of NEM 3.0 are realized over the coming years. While New York and Massachusetts each had down quarters, this near-term result is attributable to the CCI segment’s low quarterly number of installations and will likely be mitigated by the pipeline of new projects expected to come online in 2024 and 2025.

The U.S. energy storage market is expected to see 12.9 GW deployed across all segments in 2024. New capacity additions are due to break the 10 GW mark for the first time ever, with 75 GW forecasted across all segments through to 2028, according to the report. Wood Mackenzie’s five-year grid-scale forecast has increased by 5% QoQ in MW-terms, largely driven by an increased pipeline of announced projects. The pipeline increase brings the cumulative volume of new additions through 2028 to 62.2 GW.

News item from Wood Mackenzie