A study commissioned by First Solar analyzed the company’s actual and forecast U.S. spending in 2023 and 2026 when the company expects to have 14 GW of annual nameplate capacity across Alabama, Louisiana, and Ohio.

First Solar, Inc. commissioned an economic analysis of the vertically integrated solar manufacturer’s value chain in the United States. The company is unique in the U.S. solar manufacturing landscape because it offers vertically integrated solar manufacturing facilities capable of production across the entire supply chain.

The study, conducted by the Kathleen Babineaux Blanco Public Policy Center at the University of Louisiana at Lafayette, analyzed First Solar’s actual and forecast U.S. spending in 2023 and 2026 when the company expects to have 14 GW of annual nameplate capacity across Alabama, Louisiana and Ohio.

Manufacturing

First Solar produces thin film solar modules in a single process that allows the company to transform a sheet of glass into a fully functional solar panel in approximately four hours. At the end of 2023, First Solar had over 6 GW of operational manufacturing capacity in the U.S., and that figure will grow as new facilities become operational.

In addition to expanding its Ohio footprint to over 7 GW of annual nameplate capacity in 2024, the company expects to invest over $2 billion in new manufacturing facilities in Alabama and Louisiana, which are expected to come online in 2024 and 2026, respectively. First Solar is also investing up to $450 million in R&D infrastructure in Perrysburg, Ohio, expected to be operational in 2024.

Between 2016 and 2026, First Solar expects to have invested approximately $4 billion in manufacturing and research and development infrastructure in the U.S.

Jobs

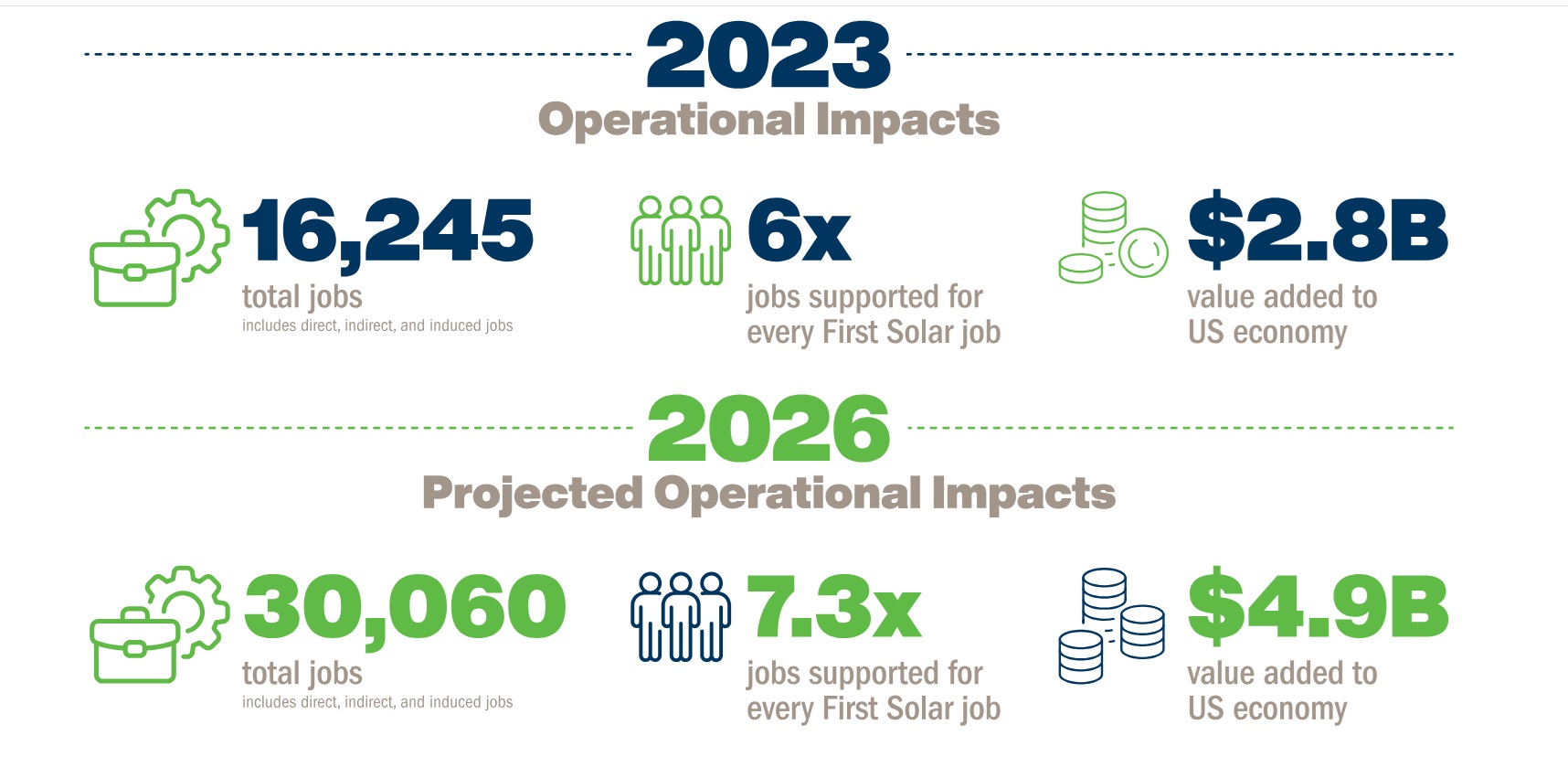

The study found that in 2023 First Solar supported an estimated 16,245 direct, indirect, and induced jobs across the country, representing $1.59 billion in annual labor income.

“This report reflects the real value of solar technology made in America for America, with materials sourced from businesses across the country, and not simply assembled here using imported components,” said Mark Widmar, chief executive officer, First Solar. “We know that our investments, catalyzed by the Inflation Reduction Act, are enabling jobs and bringing prosperity to communities in places such as Lawrence County, Alabama, Iberia Parish, Louisiana, and Crawford County, Pennsylvania, and this report helps quantify the extent of our contribution to the US economy in real terms.”

As part of First Solar’s manufacturing expansion, the report said that the company supported a total of 16,245 direct, indirect, and induced jobs in 2023, or nearly $1.6 billion in labor income in the U.S. economy. Furthermore, its operations are support nearly $2.8 billion in value added and almost $5.3 billion in total output, when including indirect and induced economic effects., according to the report.

Looking toward the future, the report says that the company’s expansion will provide more than 30,000 jobs and nearly $2.8 billion in labor income. By 2026 it is expected that First Solar will support nearly $5 billion in value added and over $10 billion in output to the U.S. economy.

Overall, assuming that the company achieves its 14 GW of nameplate capacity in the U.S. in 2026, it is forecast to add an estimated $4.99 billion in value and $10.18 billion in output to the U.S. economy in 2026 alone. In two years, First Solar is expected to directly employ 4,100 people, and with 7.3 jobs supported for every First Solar job, the report concludes that this represents an estimated total labor income of $2.78 billion including direct, indirect, and induced effects.