Mercom Capital Group reported that solar companies raised more capital in 2023 than in any other year in more than a decade. The clean energy communications and consulting firm released its annual report on funding and merger and acquisition (M&A) activity for the solar sector in 2023.

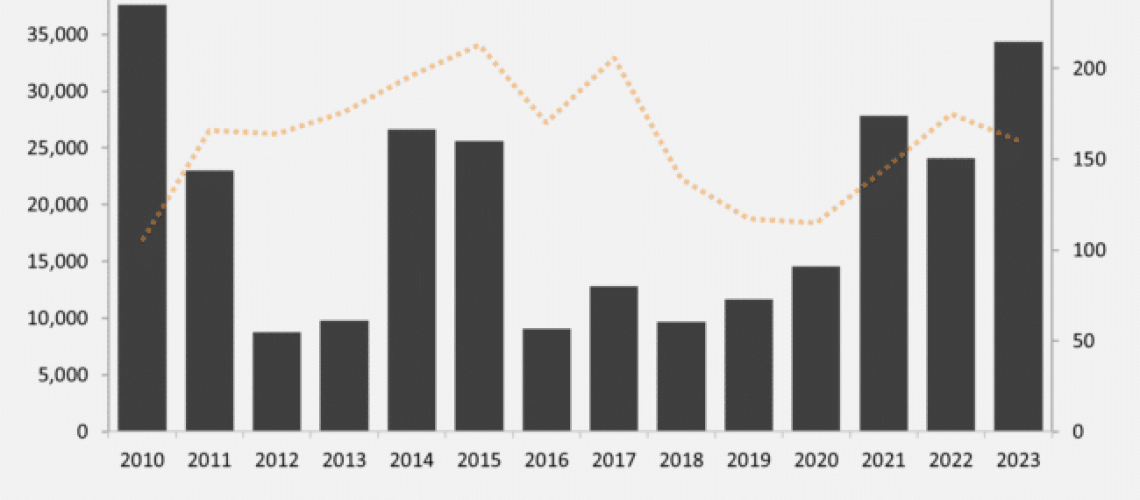

Total corporate funding, including venture capital (VC) funding, public market, and debt financing into the solar sector, increased 42% year-over-year (YoY) in 2023, with $34.3 billion raised in 160 deals, compared to $24.1 billion in 175 deals in 2022. This was the largest amount raised in over a decade.

“Investments into solar continue to defy expectations,” said Raj Prabhu, CEO of Mercom Capital Group. “Despite high-interest rates and challenging market conditions, corporate funding in the sector was the highest in a decade. Debt financing also hit a decade high, and venture capital investments and public market financing recorded the second-highest amounts since 2010. Driven by the Inflation Reduction Act, the global focus on energy security, and favorable policies worldwide, solar continues to attract significant investments.”

Global VC and private equity funding in the solar sector in 2023 came in strong with $6.9 billion, just 1% lower than the $7 billion raised in 2022. There were 26 VC funding deals of $100 million or more in 2023.

Of the $6.9 billion in VC funding raised in 69 deals in 2023, $4.7 billion (68%) went to 42 Solar Downstream companies. Solar PV companies raised $1.9 billion; Balance of System (BOS) companies raised $311 million; and Service Providers raised $32 million.

The top VC-funded companies in 2023 were 1KOMMA5° ($471 million), Enfinity Global ($428 million), Silicon Ranch ($375 million), CleanMax Solar ($360 million) and Juniper Green Energy ($350 million)

Public market financing in 2023 totaled $7.4 billion, 45% higher than the $5.1 billion in 2022.

In 2023, announced debt financing came to $20 billion, 67% higher compared to $12 billion in 2022 and the highest amount raised since 2010. Securitization activity was a key contributor, with $3.4 billion in 11 deals.

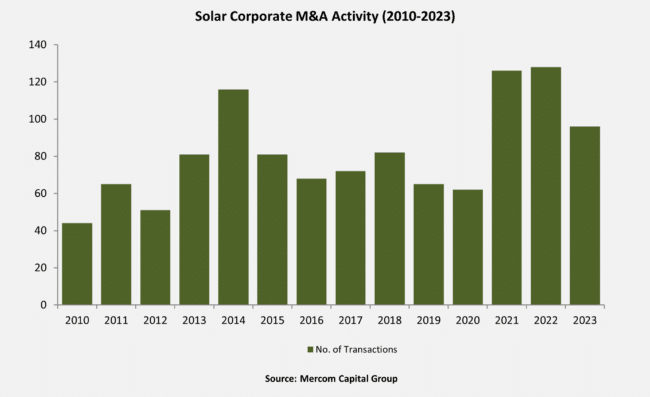

M&A activity declined 25% YoY with 96 corporate M&A transactions in 2023 compared to 128 in 2022. The largest transaction was by Brookfield Renewable, which agreed to acquire Duke Energy’s unregulated utility-scale commercial renewables business in the U.S. for approximately $2.8 billion.

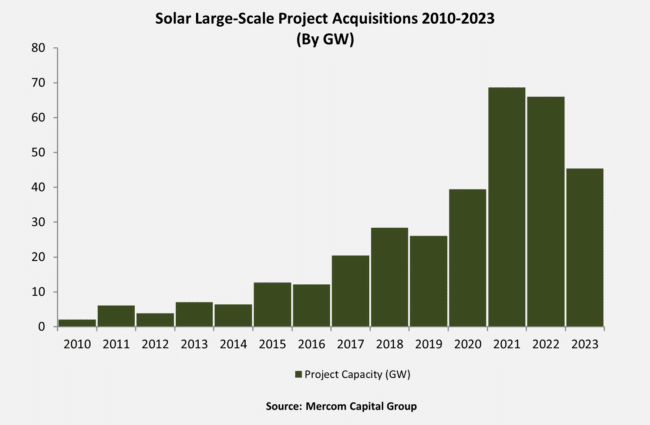

“While funding activity has been strong, macroeconomic and geopolitical uncertainties, recession worries, and elevated interest rates have significantly slowed down both corporate and project M&A activity in 2023,” noted Prabhu. “Higher borrowing costs have put a damper on M&A transactions, with cautious investors biding their time for more favorable valuations. Solar projects continue to attract interest, but high valuations and a lower risk appetite, compounded by unpredictable project completion timelines due to interconnection delays, labor shortages, and scarcity of components, have all contributed to a drop-off in project M&A activity,” Prabhu added.

Solar Downstream companies led corporate M&A activity in 2023, acquiring 84 solar companies, followed by Manufacturers with five, Service Providers with four, and Balance of System (BOS) companies with three acquisitions.

There were 231 large-scale solar project acquisitions in 2023 compared to 268 acquisitions in 2022. In 2023, almost 45.4 GW of solar projects were acquired in 2023, compared to 66 GW in 2022 a 31% decline YoY.

Almost 45.4 GW of large-scale solar projects were acquired in 2023, with 35% of the total being acquired by Project Developers and IPPs. Investment Firms acquired 23%, followed by Utilities with 17% of acquisitions.

Mercom’s 127-page “Annual and Q4 2023 Solar Funding and M&A Report” covers 250 companies and investors and contains 103 charts, graphs and tables.

Tags: Financing, market research, Mercom Capital Group