In recent years, the United States has made substantial progress in embracing a renewable energy revolution, positioning itself on a path toward a more sustainable future. This transition is being propelled by a convergence of factors, including environmental concerns, economic opportunities and advancements in technology.

With the introduction of the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law (BIL), the U.S. is accelerating its move toward clean energy solutions.

To illustrate the extent of this progress, consider the following key statistics: In 2022, the share of renewable energy sources (RES), including hydroelectric power, in the nation’s electricity generation had reached approximately 22%; furthermore, the share of RES in the total electricity generation capacity had increased to approximately 30%.

Notably, in the transportation sector, there is also a growing awareness among consumers, who are increasingly opting for zero-emission fuels, such as electric vehicles. In 2022, the battery electric vehicles (BEVs) share in new vehicle registrations stood at 5.6%, and by the first half of 2023, the share had surged to 7.1%, according to EUPD Research estimates.

The U.S. has set ambitious targets, including achieving 100% carbon pollution-free electricity by 2035 and aiming for economy-wide net-zero greenhouse gas emissions by no later than 2050. These targets are expected to provide a significant boost to the clean energy sector in the country, further reinforcing its commitment to a sustainable and environmentally responsible future.

IRA and BIL fueling the boom

The IRA and BIL mark an epochal shift in the landscape of clean energy policy, heralding a new era for the solar and energy storage sectors in the U.S. The IRA allocates substantial resources toward addressing the climate crisis, bolstering domestic clean energy production, and solidifying the U.S. role as a global leader in clean energy manufacturing.

According to U.S. Department of Energy (DOE), a substantial investment exceeding $120 billion in the U.S. battery manufacturing and supply chain sector has been announced since the introduction of IRA and BIL. Furthermore, plans have been announced for the establishment of more than 200 new or expanded facilities dedicated to minerals, materials processing and manufacturing. This is anticipated to create over 75,000 potential job opportunities, strengthening the country’s workforce.

After the introduction of IRA and BIL, solar PV manufacturing in the U.S. has also seen a substantial surge in planned investments, amounting to nearly $13 billion, according to the DOE. Furthermore, a total of 94 new and expanded PV manufacturing plants have been announced, which could potentially create over 25,000 jobs in the country.

Surging solar sector

In recent years, the solar sector in the U.S. has outpaced other energy sources, including wind and natural gas, in terms of capacity growth. EUPD Research estimates reveal a noteworthy upward trajectory in the contribution of solar capacity to annual power capacity additions. This trend has seen a rise from 37% in 2019 to 38% in 2020, further increasing to 44% in 2021, and reaching an impressive 45% in 2022.

Annual PV capacity in the U.S. has been steadily rising in the past years, albeit with a temporary setback in 2022 caused by pandemic-related delays, enforcement of trade laws, disruptions in the supply chain, and increasing costs. (The country installed 21.1 GWdc of PV capacity in 2022, as compared to 23.1 GWdc in 2021.)

The U.S. now is on track to make an historic addition to its PV capacity in 2023. According to EUPD Research’s 2023 forecast, the U.S. is poised to achieve its largest-ever expansion in PV capacity, with an estimated 32 to 35 GWdc, if all the planned utility-scale capacity gets installed. Moreover, in the period from 2023 to 2028, the U.S. is estimated to add approximately 233 GWdc of PV capacity.

To learn more about how EUPD collects historical installed PV and storage data and make projections for future installed capacity, see EUPD Research’s Global Energy Transition (GET) Matrix.

In terms of cumulative installed PV capacity (utility-scale + C&I + residential) on a state-by-state basis, California holds the top position followed by Texas, Florida, North Carolina and Arizona. Notably, Texas is rapidly expanding its utility-scale PV capacity, and it is poised to potentially surpass California within the next two years.

Rapid expansion of battery storage

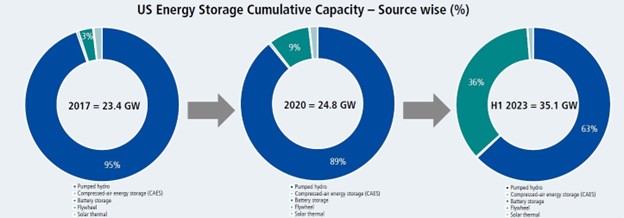

Battery energy storage has emerged as the dominant and rapidly expanding source of energy storage in the U.S. in recent years. The proportion of battery storage in the country’s energy storage capacity has surged dramatically, climbing from a mere 3% in 2017 to a substantial 36% in the first half of 2023.

In the U.S., battery storage capacity additions have been dominated by utility-scale installations. The rise of intermittent energy sources like solar and wind has made utility-scale batteries increasingly important. According to the DOE, the majority of planned utility-scale battery storage capacity is being installed alongside solar and wind facilities in the U.S.

At the end of 2022, around 9 GW/23.24 GWh of utility-scale battery storage capacity was installed in the U.S., as per EUPD Research estimates. Our projections show that in the year 2023, the U.S. is estimated to install a substantial 9.6 GW/26.4 GWh of utility-scale battery storage capacity, surpassing the cumulative installed capacity up to 2022.

In terms of total installed battery storage capacity (utility-scale + small-scale), California at present holds the top position followed by Texas, Florida, Hawaii and Arizona.

Unveiling the top installers

Crucial to the flourishing solar and storage industry in the U.S. are the downstream players, specifically installers. These entities play a pivotal role in driving sector expansion and shaping its trajectory. To ensure continued growth and success, understanding the landscape of the top installers in the country is imperative.

Against this context, EUPD Research in its recently published report “Market Leadership Study: The United States 2023” came out with a ranking of the top installers in the U.S. distributed generation market. We also conducted a comprehensive evaluation of top installers, creating a data-driven snapshot of their competitive positioning. The installers were ranked using a rigorous methodology that considers various critical factors, such as installed capacity, sector coupling, vertical integration, financing options, and more. Each of these factors was assigned a specific weighting to determine the final rankings.

EUPD Research is pleased to reveal the names of the top 10 distributed installers in the U.S., according to our report. Topping the list are industry giants Sunrun, Sunpower, and Tesla Energy, in positions 1, 2, and 3, respectively. The remaining companies in the top 10 are: Sunnova, ADT Solar, Palmetto Solar, Freedom Forever, Trinity Solar, Titan Solar Power, and Momentum Solar.

In conclusion, the U.S. stands at the cusp of an energy revolution, propelled by ambitious targets and landmark legislation. The solar PV and energy storage sectors are witnessing unprecedented growth, guided by substantial investments and a surge in installations. With industry leaders driving innovation and sustainability, the nation is poised to achieve its clean energy goals, reaffirming its commitment to a greener future.

Markus A.W. Hoehner is the founder and CEO of EUPD Research. Markus has over three decades of extensive expertise in top-level research and consulting, with a particular focus on renewable energies, the clean tech sector, and sustainable management. He is a dedicated advocate of the global energy transition and has actively championed this cause by spearheading various initiatives, projects, and enterprises aimed at fostering the expansion of sustainable industries on a global scale.

Markus A.W. Hoehner is the founder and CEO of EUPD Research. Markus has over three decades of extensive expertise in top-level research and consulting, with a particular focus on renewable energies, the clean tech sector, and sustainable management. He is a dedicated advocate of the global energy transition and has actively championed this cause by spearheading various initiatives, projects, and enterprises aimed at fostering the expansion of sustainable industries on a global scale.