A Wood Mackenzie report forecasts that China will hold more than 80% of poly, wafer, cell and module manufacturing capacity for the next three years.

The recent report “How will China’s expansion affect global solar module supply chains?” finds that China’s policy support for and investment in manufacturing across the solar supply chain will keep the country on top in terms of capacity through 2026.

China has invested an estimated $130 billion into its solar industry this year, according to the Wood Mackenzie report. With more than 1 TW of wafer, cell and module forecast to come online in the next year, China will have enough capacity to meet global demand through 2032, the report says.

“China’s solar manufacturing expansion has been driven by high margins for polysilicon, technology upgrades and policy support,” said Huaiyan Sun, senior consultant at Wood Mackenzie, and author of the report. “And despite strong government initiatives for developing local manufacturing in overseas markets, China will still dominate the global solar supply chain and continue to widen the technology and cost gap with competitors.”

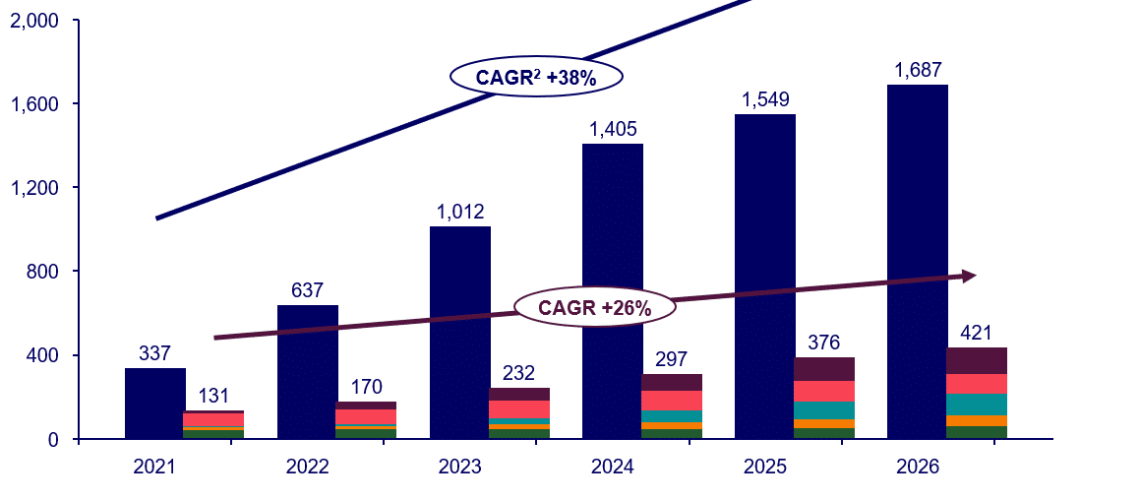

The report forecasts that China will hold more than 80% of the world’s polysilicon, wafer, cell, and module manufacturing capacity from 2023 to 2026. In addition, not only will the country dominate in capacity, its product will come at a lower cost. For example, the report says that a module made in China is half the price of that made in Europe and 65% less than that made in the U.S.

This comes as no surprise because, as noted at the recent pv magazine Roundtables US 2023, building a supply chain takes time. It has been just over a year since the passage of the Inflation Reduction Act (IRA) in the U.S., which includes $370 billion to support renewable energy build out. Expert panelists noted that they expect the U.S. to be heavy with downstream solar manufacturing, and “we’ll have to continue to rely on imports from foreign partners for polysilicon, ingots and wafers to the U.S.,” said MJ Shiao, vice president of supply chain and manufacturing for the American Clean Power Association. Shiao estimated that it can take from three to five years to build new polysilicon manufacturing.

The buildout of U.S. solar manufacturing will begin with modules, which Shiao said is the smart way to go to ensure that we meet the downstream demand, then start to look for more of the upstream part of the supply chain to meet domestic demand. But upstream manufacturing takes time, the panelists agreed.

“Despite considerable module expansion plans, overseas markets still cannot eliminate their dependence on China for wafers and cells in the next three years,” Sun said.

The U.S. isn’t the only region seeking wafer and cell capacity. As seen in the chart below, Europe and the U.S. both have polysilicon and module capacity, but fall far short in wafers and cell. Southeast Asia, on the other hand, has nearly matched capacity for cells and modules, with India not far behind. But India is also experiencing a strong build out in solar manufacturing, thanks to strong government policy in the form of PLI incentives, and the Wood Mac report forecasts that India will overtake Southeast Asia as the second-largest module production region by 2025.

As other regions are slower to ramp up cell production, China will continue to be the leader in capacity, holding an estimated 17 times more cell capacity than the rest of the world.

However, it is not without its challenges. The report notes that China has recently announced the termination of more than 70 GW in capacity due to oversupply and competition. This mainly concerns old production lines that produce lower efficiency P-type and M6 cells. Wood Mac analysts expect P-type cells to decline to just 17% of supply by 2026.