Curtailment, or deliberately reducing output, rises as solar generation exceeds available transmission capacity.

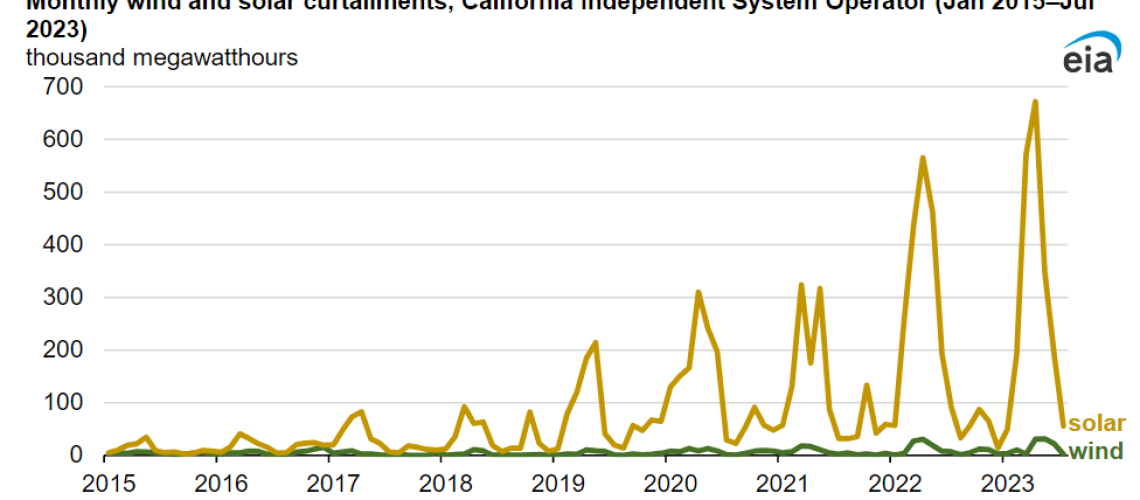

Curtailment of renewable energy, particularly solar generation, is steadily on the rise in California, as reported by the Energy Information Administration (EIA).

In 2022, the California Independent System Operator (CAISO) curtailed 2.4 million MWh of solar and wind generation. Solar accounts for 95% of that total.

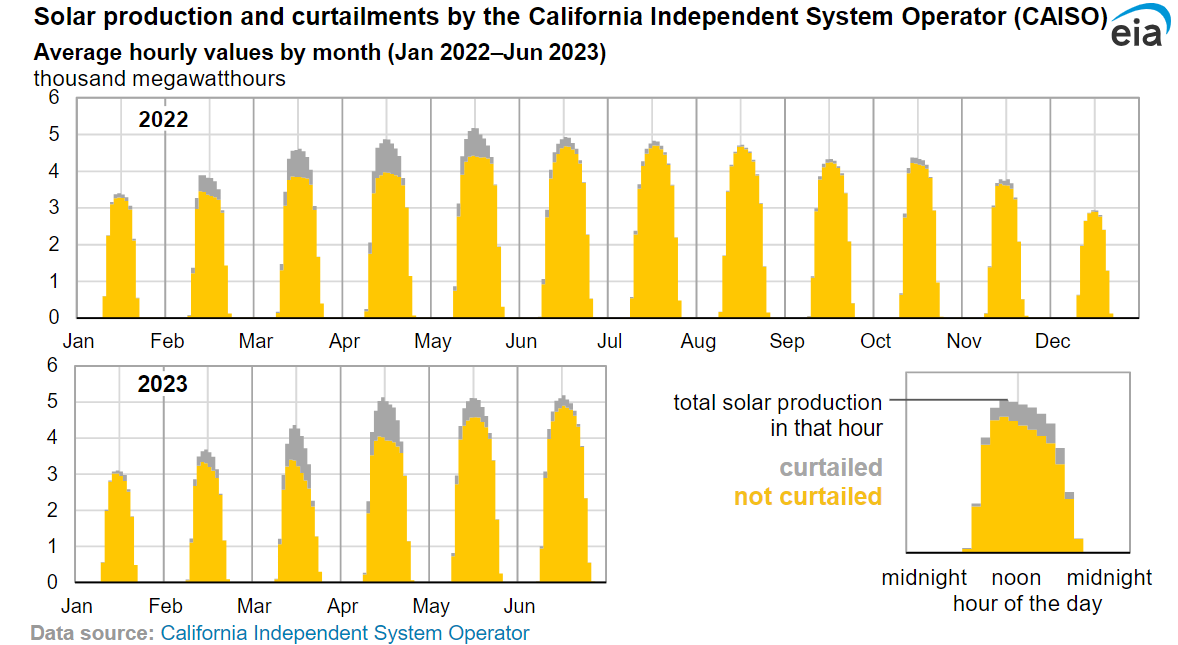

As intermittent solar generation increases, a lack of available transmission infrastructure or energy storage capacity is causing temporary gluts of generation. Curtailment occurs either when there is congestion, when power lines don’t have enough capacity to deliver the power, or during oversupply, when electricity generation exceeds customer demand.

In California, curtailment is largely a result of congestion, said EIA. Congestion-related curtailments have been steadily on the rise since 2019 as solar generation additions outpace transmission and storage additions.

CAISO tends to curtail solar the most in the spring when electricity demand is generally low due to moderate temperatures and production is relatively high due to sunnier conditions.

Three solutions

The system operator is working on a few solutions to the curtailment problem. One pathway to alleviate curtailment is to participate in the Western Energy Imbalance Market (WEIM), a real-time market that allows participants outside CAISO to buy and sell energy to balance supply and demand. In 2022, more than 10% of total possible curtailments were avoided by trading in this market, said EIA. A day-ahead market is expected to be added to WEIM in Spring 2025.

CAISO is also expanding transmission capacity to alleviate congestion. Its 2022-2023 transmission planning report outlines 45 projects to accommodate a growing share of renewables. The look-ahead plan is adding significant capacity to meet the 40 GW of generation capacity expected to be added to the system over the next ten years.

As a third method, CAISO is promoting the development of flexible resources that can respond to demand. The state currently has 4.6 GW of battery energy storage, and developers plan to add 7.6 GW by the end of 2024, based on EIA data.

Duck curve

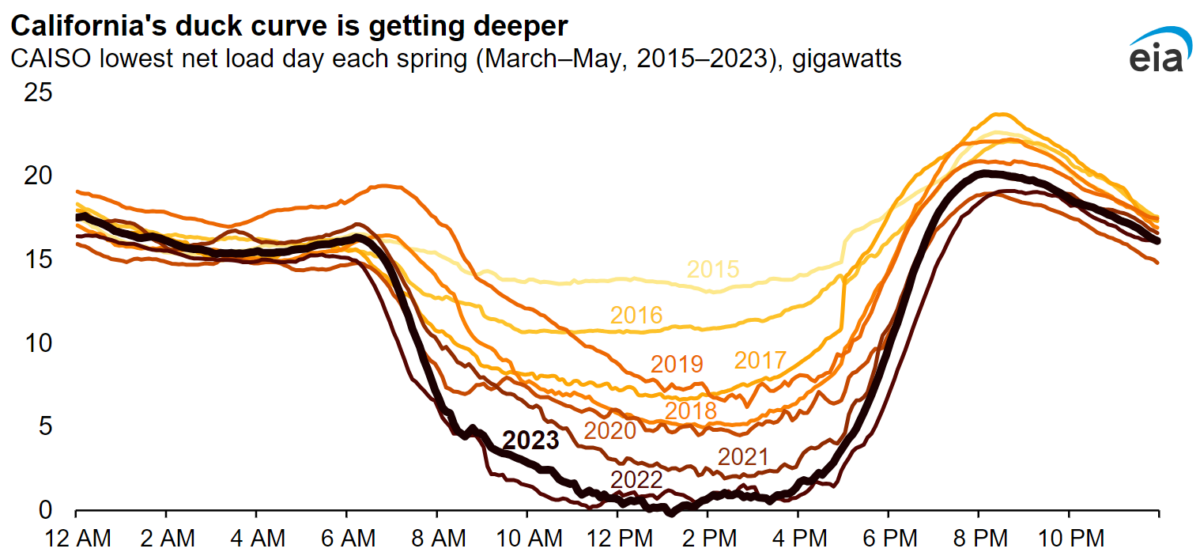

Another way to understand the effect of intermittent renewables on traditional centralized transmission grid operation is via the “duck curve” model.

The phenomenon of the “duck curve” is an electric grid operation concept that signifies the mismatch between peak solar generation (mid-day to afternoon) and peak electricity demand (late afternoon and evenings). Shaped like the outline of a duck, the curve shows the peaks and valleys of this mismatch throughout a typical day.

The experience of a duck curve can cause stress on the grid and challenges for the electricity market, causing California and other solar-friendly states to boost adoption of energy storage to meet these challenges.

The EIA shared that as solar adoption grows in California, the “duck curve” is deepening. The midday dip in net load is getting lower, making it more difficult for the California Independent System Operator (CAISO) to balance the grid.

The swing in demand for electricity from conventional power plants from midday to late evenings, when energy demand is still high but solar generation has dropped off, means that conventional power plants like natural gas-fired peaker plants must rapidly ramp up electricity production to meet demand. That rapid ramp up makes it more difficult for grid operators to match grid supply with grid demand in real time, a mechanism that balances the grid both physically and in the wholesale marketplace.

However, the duck curve has opened the door for energy storage to meet the grid-balancing needs of California and other renewables-based economies.

“The large-scale deployment of energy storage systems, such as batteries, allow some solar energy generated during the day to be stored and saved for later, after the sun sets,” said EIA. “Storing some midday solar generation flattens the duck’s curve, and dispatching the stored solar generation in the evening shortens the duck’s neck.”

Despite its higher total project costs, solar-plus-storage has an advantage in capture price, said global risk assurance firm DNV. Plants with storage can charge their batteries when sunlight is plentiful during the day and sell the stored electricity when the price is high. DNV said that by 2038, the capture price advantage of solar and storage co-located projects will surpass the cost disadvantage, making these projects even more attractive.

“PV and storage systems are designed as a ‘package’ that can produce energy on demand, just like hydropower, nuclear, or combustion power plants,” said DNV.

In 10 years, DNV said roughly 20% of solar projects worldwide will be built with dedicated storage, and by mid-century such projects will reach about 50%.