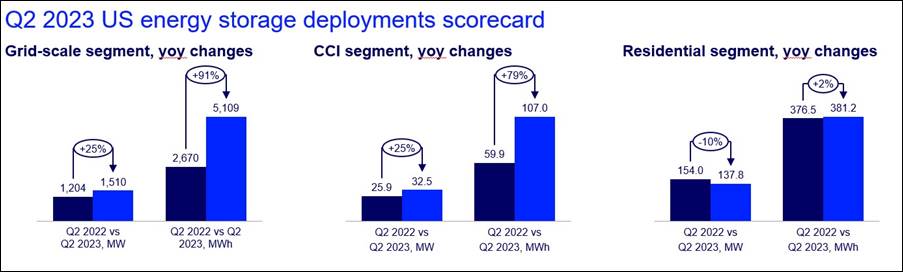

The U.S. energy storage market added 5,597 MWh in Q2 2023, a new quarterly record. This is according to the latest “U.S. Energy Storage Monitor” report from Wood Mackenzie and the American Clean Power Association.

The grid-scale segment led the way in Q2 with a record-breaking 5,109 MWh in Q2, beating the previous record in Q4 2021 by 5%. The grid-scale segment also achieved 172% growth quarter-over-quarter. California dominated activity, with 738 MW and a 49% share of installed capacity.

Source: US Energy Storage Monitor Q3 2023 | American Clean Power Association, Wood Mackenzie

“The energy storage market is on pace for a record year, as utilities and larger power users increasingly turn to storage to enhance the grid and improve reliability,” said ACP VP of Research and Analytics John Hensley. “The market is on pace to nearly double annual installations despite supply chain challenges and interconnection delays and will continue to grow quickly in coming years.”

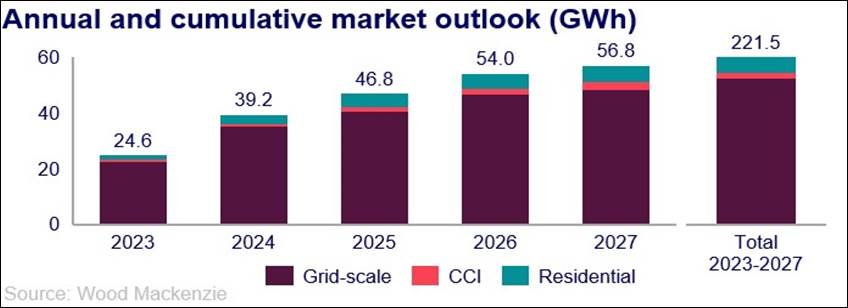

Wood Mackenzie projects the grid-scale segment to be the main driver of the market in its five-year forecast from 2023-2027, accounting for 83% of total installations, or 55 GW.

“We saw a huge bounce back in Q2 after consecutive quarterly declines in the market,” said Vanessa Witte, senior analyst with Wood Mackenzie’s energy storage team. “Many projects delayed from prior quarters, largely due to supply chain issues, were able to come to fruition this past quarter. However, even with the record, the projected pipeline did not fully materialize, with more than 2 GW pushed back.”

Source: US Energy Storage Monitor Q3 2023 | American Clean Power Association, Wood Mackenzie

Community, commercial, and industrial (CCI) installations, at 107 MWh, were higher than any quarter in 2022 but could not keep pace with the huge spike in Q1 installations, resulting in a 53% quarterly decline. However, the segment is still up 25% year-over-year.

Residential storage recorded its second-straight quarter of decline at 381.2 MWh, behind Q1’s 388.2 MWh. California has seen the biggest decline, decreasing 17% quarter-over-quarter and 37% year-over-year.

“We still project strong growth for the residential segment in our five-year outlook, reaching a total of 8.0 GW in 2027,” Witte said. “However, the CCI segment continues to fail to meet growth projections and we have downgraded its five-year growth forecast by 28% to 3 GW.”

News item from WoodMac