The United States is now deemed most attractive for renewable energy investors worldwide, following landmark funding in the Inflation Reduction Act (IRA) and high demand for economy-wide decarbonization.

A survey by the American Council on Renewable Energy (ACORE) found that 100% of its respondents perceive the U.S. market to be increasing in attractiveness relative to other major countries in renewable energy investment.

The response, made by executives from 43 leading companies with $100 million in annual revenues or investments, is the first time in the ACORE survey’s history that the United States has unanimously been perceived to be increasing in relative attractiveness to other nations.

“The IRA is going to… make markets that have not historically been available, available,” said a surveyed investor.

“Direct pay, transferability, and long-term tax extensions have transformed uneconomic projects into ones with healthier margins and are allowing us to expand our portfolio,” said another investor in the ACORE survey.

The relative strength seen in the U.S. market comes at a serendipitous time, as renewable energy investment globally now nearly doubles that of the fossil fuels. For every dollar invested in fossil fuels, $1.70 is invested in clean energy technologies. This marks a fast divergence from five years ago, when fossil fuels and clean energy investments were essentially even.

Global clean technology investment is expected to reach $1.7 trillion in 2023, with PV leading the way as the largest contributor of energy generation, said the International Energy Agency.

While the report showed positive sentiments about the prospects of the U.S. renewable energy investment market from 2023 to 2026, there are still numerous challenges for the industry to overcome.

“Grid-related constraints, supply chain challenges, trade restrictions, tax credit monetization uncertainties, anti-ESG actions, and inflation are hindering the rate of sector growth. Project financing in particular will be constrained over the mid-term as it faces unprecedented demand from developers,” said the report authors.

Despite solar project investment pulling back 8% in 2022, largely due to supply chain constraints and tariff threats, 84% of survey respondents said that they plan to increase renewable energy investment by 5% or more in 2023.

Much of the uncertainty that plagued the U.S. solar investment market in 2022 is peeling back this year, as investors expressing uncertainty lowered from 16% of respondents in last year’s survey to 4% this year.

“2H 2021 and 2022 were full of equipment delays. In 2023, we’re finally catching up and deploying megawatts that were planned for 2022,” commented a developer in the survey.

While this reported uncertainty has lowered, many other headwinds of 2022 persist in the 2023 market.

“Supply chain issues (primarily tariff and other trade restrictions in the solar supply chain) and interconnection queues are our two biggest challenges, followed by the absence of much needed transmission upgrades to existing systems; and new transmission build-out,” said one surveyed developer.

Grid interconnection queue delays were cited as a major bottleneck for solar developers, bogged down by heavy costs and slow administrative processes by utilities and grid operators. However, the issue has been placed under the spotlight, as federal agencies and national labs go to work to develop pathways for speeding up and lowering costs.

“The appetite is there, and well-funded sponsors can get access to whatever they need. Queue delays are a huge issue now, although I think they’re shaking out,” said a developer in the ACORE survey.

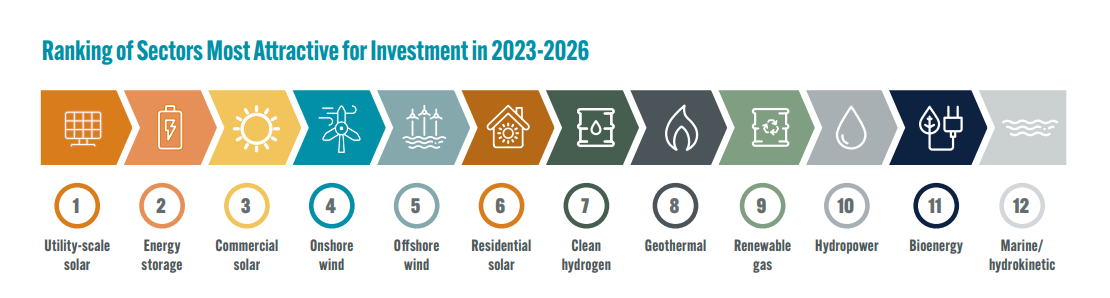

Surveyed investors collectively ranked utility-scale solar, energy storage, and commercial solar as the top three most attractive clean energy sectors for investment over 2023-2026.

The respondents ranked the PJM region as the most attractive for renewables investment over a three-year span, followed by MISO, CAISO, ERCOT, and ISO-NE. Developers responded slightly differently, ranking the top five grid regions as follows: PJM, ERCOT, MISO, CAISO, ISO-NE.

Tax credit incentive adders based on meeting domestic content requirements in renewable energy projects, stacked with tax credits for manufacturing components in the U.S., are making the nation a top target for building new factories.

More than one-third of investors, about 38%, reported plans to invest in clean energy manufacturing in the U.S.

“There will be a number of opportunities in the onshoring of manufacturing, particularly around [storage] battery plants and wind energy manufacturing and assembly facilities,” said an investor in the survey.

Traditional investors are not the only ones supporting the domestic content push. About 28% of developers reported plans to open a new manufacturing plant, and 33% said they plan to incentivize their suppliers to open domestic facilities. Furthermore, 11% of developers said they intend to directly invest in domestic manufacturing plants.