The Public Advocates Office (PAO) for the California Public Utilities Commission (CPUC) has released a proposal to add a monthly fixed charge on electric utility bills that is based on income level.

The rate change is designed to lower bills for the lowest-income residents, while aligning billing more directly with utility costs.

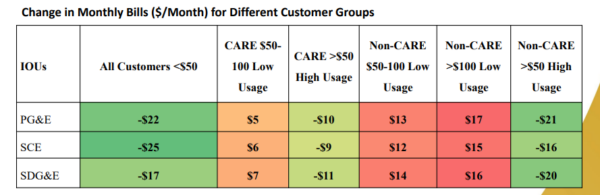

PAO’s recommendation for the Income Graduated Fixed Charge places fees between $22 per month and $42 per month in the three major investor-owned utilities’ territories for customers not enrolled in the California Alternative Rates for Energy (CARE) program. CARE customers would be charged between $14 per month and $22 a month, depending on income level and territory, as seen below.

For households earning $50,000 or less per month, the fixed charge would be $0, but only if the California Climate Credit is applied to offset the fixed charge.

Meanwhile, usage-based electricity rates are lowered in the PAO proposal. Average rates would be lowered between 16% to 22% for the three major investor-owned utilities.

The lowest-income bracket of Californians is expected to save roughly $10 to $20 a month under the proposal, while middle-income customers may see costs rise by about $20 a month.

“We anticipate the vast majority of low-income customers ($50,000 or less per year) will have their monthly bills decrease by $10 or more, and a small proportion of the highest income earners ($100,000+ per year) will see their monthly bills rise by $10 or more,” said the PAO.

The charges are an effort to help suppress ever-increasing rates for electricity generation and transmission, which are among the highest in the country. Rates are expected to continue to rise sharply as wildfire mitigation efforts are being implemented by the utilities that were found at fault for their origin.

“We are very concerned. We do not see the increases stopping at this point,” Linda Serizawa, deputy director for energy, PAO, told pv magazine. “In fact we think the pace and scale of the [rate] increases is growing faster than we would have anticipated, for several years now.”

The proposed charges are also meant to more directly couple billing with the fixed charges that utilities incur. Activities like power line maintenance, energy efficiency programs, and wildfire prevention are not expected to vary with usage, so these activities would be funded through the fixed charge.

Michael Campbell of the PAO’s customer programs team, and leader of the proposed program, likened paying for grid enhancements and other social programs with utility rate increases to “paying for food stamps by taxing food.” Instead, a fixed charge would cover these costs.

PAO said the move to lower rates for usage should help encourage electrification as California moves to replace heating and cooling, appliances, and gas combustion cars with electrified counterparts. Lower rates mean the cost burden of running these devices is improved.

However, the program is expected to provide more savings to high energy users than to those who use less electricity. This aspect of the policy works in direct contrast to goals of energy efficiency, and is a boon to investor-owned utilities that benefit from serving increased electricity demand.

What about solar?

While the progressive fixed charge may marginally lighten costs for the lowest-income customers, analysts fear that the charges are a penalty to rooftop solar customers.

The fixed charge arrived on the heels of passing Net Energy Metering (NEM) 3.0, which slashed compensation rates for exporting clean, local energy to the electric grid by about 80%. NEM 3.0 requires solar customers to rely on self-consumption, charging a home battery and using their own production.

Solar customers would be subject to the fixed charge, even those who store their power and draw little to no power from the grid. This is damaging to the economics of rooftop solar, and would be a disincentive for new installations. Lowered rooftop solar adoption leads to more reliance on utility-built centralized generation and transmission infrastructure.

However, the PAO said this ratemaking proposal is more about affordability, equity, and readying for electrification.

“This is not about solar,” said Campbell. “This is about equity and trying to promote the state’s bold climate goals [to promote more electrification]. Having all of our costs put into a volumetric rate is at a collision course with that.”

Wildfire fund

Much of the funds from the fixed charge are to be directed to wildfire recovery funds and wildfire hardening costs, said PAO.

Pacific Gas and Electric (PG&E), the state’s largest investor-owned utility, has been found at fault for wildfires due to negligent safety practices for long-distance transmission lines.

In 2017, PG&E’s downed transmission wires were found to be the cause of massive wildfires and leaving many Californians without homes. The company was stuck with a $7.5 billion bill as it was found at fault for negligence in maintaining vegetation around its centralized transmission wires. These costs incurred by the utilities are harmful to all Californians, as the financial fallout from these disasters is picked up by ratepayers in the form of a higher bill.

Rather than having ratepayers at large bail out the major investor-owned utilities for their negligence in transmission requirements, environmentalists and solar industry advocates argue that the CPUC should instead focus on incentivizing technologies like distributed rooftop solar, which lessen the need for regional transmission buildout and offer backup power in times of grid outages.

Microgrids

The CPUC has made some moves towards supporting localized resilience through distributed assets, though it has been perceived as a “Jekyll and Hyde” approach.

On the same day that the CPUC rejected an application from rooftop solar provider Sunnova to implement a microgrid community, it announced a $200 million microgrid program for the investor-owned utilities to roll out.

(Read: “How solar emergency microgrids provide resilience to vulnerable communities“)

“It is interesting because that is, in fact, a cost shift,” Meghan Nutting, executive vice president, government and regulatory affairs at Sunnova Energy, told pv magazine. “The non-participating ratepayers will have to contribute to that $200 million that utilities will use to deploy microgrids. Then [investor-owned utilities] will receive a rate of return for any money they spend to build them, causing another cost shift onto non-participants,” she said.

What’s next?

If implemented, the Income Graduated Fixed Charge is expected to roll out in Summer 2024. Implementation may prove to be difficult, as income levels will need to be proven to utility companies to justify rates.

One method the CPUC has proposed is to automatically place all Californians in the highest income bracket, and ratepayers must opt-in to a program that allows investor-owned utilities to access their income information to be placed in a less-costly tier.

Norm Miller, emeritus professor of the University of San Diego’s Knauss School of Business, warned that it may be undesirable to ““inject utility companies into the personal finances of households.”