EnergySage, a residential solar and storage informational site, released its semiannual market report, now in its eighth year. The report analyzes millions of transaction-level data points gathered from quotes sent to homeowners shopping on the website throughout 2022.

Quoted residential solar prices rose in 2022, climbing 6.7% from 2021 prices, when they reached a new bottom. The average price for solar quoted on EnergySage was $2.85 per Watt in 2022.

Energy storage increased in quote prices in 2022 as well, rising by $50 per kWh stored, or about 4%, from 2021 to 2022. EnergySage said most quoted battery prices fall between $13,000 and $18,000 for a single battery. Median storage pricing has risen from $1,140 in H2 2020 to $1,339 in H2 2022.

The average quoted system size increased slightly as well, with systems averaging 10.9 kW, up from 10.2 kW from the previous year. Estimated payback periods shortened slightly, as rising utility bills outpaced rising installed solar array costs.

The top brands continue to dominate quoted systems on EnergySage’s website. Enphase, Tesla, and SolarEdge were the top three, respectively, and together accounted for about 80% market share. Homegrid Energy, the lowest-cost battery quoted on the site, was the only battery priced under $1,000 per kWh to be included in more than 1% of all storage quotes in H2 2022.

Customers requested energy storage to be included in the quote 67% of the time in 2022, while battery attachment rates were about 14% nationwide. This is down slightly from 15.5% battery attachment rates in H2 2021. California, Arizona, and Nevada had the highest battery attachment rates, while Tennessee, Indiana, and Georgia ranked within the bottom three states for battery attachment.

Among the top eight largest residential solar markets, Arizona had the lowest cost per Watt average at $2.38, while Massachusetts was the highest at $3.56 per Watt on average. California averaged $2.80 per Watt for quotes system prices in 2022. The north central U.S. has the highest quoted prices nationwide, with Indiana, Iowa, Michigan, Minnesota, and Wisconsin all at least $0.50 per Watt higher than the national median quote price. Under these median prices, a quote for the median system size in Arizona would be over $15,000 less expensive than a quote for the same system in Indiana.

Notably, 61% of EnergySage shoppers did not select the lowest-priced quote that they received during 2022. Equipment quality and installer ratings were also often considered with a final buying decision.

Average quoted system sizes were the lowest in California (8.5 kW) while Arkansas had the largest average system size (14.9 kW). The seven states with the largest quoted system sizes in H2 2022 are all south of the Mason-Dixon line. On the other hand, five of the six states with the smallest system sizes are either in the West or the Northeast, said EnergySage.

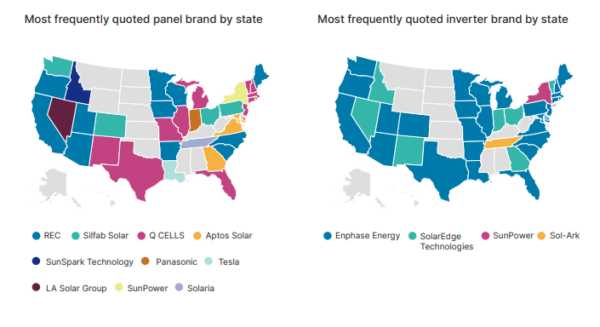

Over the last two years, Qcells has steadily gained in share in the EnergySage marketplace, overtaking REC in 2022 as the most quoted brand. Throughout all of 2022, 390 W to 400 W panels were quoted the most, with one in five quotes including a panel 400 W or larger. Nearly 100% (99.7%) were 330 W or higher.

“As installers looked to find secure supply during shortages in 2022, the share of quotes represented by the top three brands on EnergySage continued to drop–from 66% of quotes in 2021 to 58% in 2022,” said the report.

Enphase remained the most quoted inverter for the sixth-straight semiannual report. Enphase and SunPower-branded Enphase products were included in 68% of quotes on the EnergySage marketplace.

Brand loyalty continues to grow among installers. In the second half of 2022, 59% of installers offered only a single inverter brand, the highest level of brand loyalty the website has reported in any six-month period since it began tracking this information in 2014.

“2022 was a transformative year for the solar and energy storage industry, marked by moments of celebration as well as new obstacles to overcome,” said EnergySage CEO and founder Vikram Aggarwal. “While the solar tax credit was extended and expanded under the passing of the Inflation Reduction Act in August, we also saw California pass new rules that negatively affect its net metering program. Through these highs and lows, consumers continue to depend on EnergySage for help understanding and navigating the complexities of their electrification journey. Our unique, unbiased, first-party data is relied on by contractors, manufacturers, government agencies, policymakers, non-profits, and financing providers as well.”