EnergySage announced it has released its 16th Solar & Storage Marketplace Report, a semiannual report that analyzes transaction-level data points generated by quotes sent to homeowners shopping on EnergySage.com throughout the entirety of 2022 for solar panels, inverters, batteries and more.

EnergySage announced it has released its 16th Solar & Storage Marketplace Report, a semiannual report that analyzes transaction-level data points generated by quotes sent to homeowners shopping on EnergySage.com throughout the entirety of 2022 for solar panels, inverters, batteries and more.

Here are three key insights from this latest report.

Solar prices continue to increase, rising over 6% year-over-year

Ongoing equipment supply constraints continue to impact pricing, as the quoted price of solar on EnergySage has increased to $2.85/W, a 6.7% increase since the lowest price in early 2021. The installed cost of energy storage is up as well, increasing by $50/kWh stored, or 3.9%, in 2022.

More shifts in market share for the top-quoted solar panel brands

In the second half of 2022, Qcells overtook REC as the most frequently quoted panel brand on EnergySage with more than one-quarter of all quotes including Qcells panels. Additionally, as installers looked to secure their supply during shortages in 2022, the share of quotes represented by the top three brands on EnergySage continued to drop – from 66% in 2021 to 58% in 2022. Enphase remained the most quoted inverter and battery storage brand.

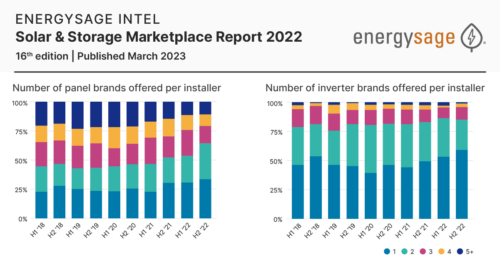

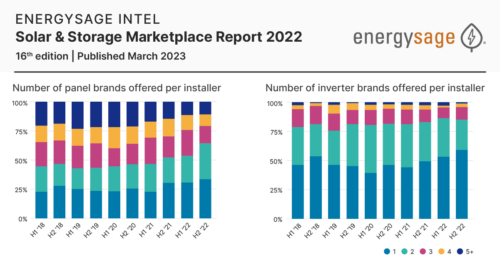

Installer brand loyalty continues to increase on EnergySage

Installer brand loyalty continues to increase on EnergySage

In the second half of 2022, 59% of installers offered only a single inverter brand, the highest level of brand loyalty since EnergySage began tracking this information in 2014. Similarly, over one-third of installers only worked with a single solar panel brand in H2 2022, the highest level since 2015. More than just installer brand loyalty, these trends provide insight into consumer choice and supply chain availability as well.

“2022 was a transformative year for the solar and energy storage industry, marked by moments of celebration as well as new obstacles to overcome,” said EnergySage CEO and founder Vikram Aggarwal. “While the solar tax credit was extended and expanded under the passing of the Inflation Reduction Act in August, we also saw California pass new rules that negatively affect its net-metering program. Through these highs and lows, consumers continue to depend on EnergySage for help understanding and navigating the complexities of their electrification journey. Our unique, unbiased, first-party data is relied on by contractors, manufacturers, government agencies, policymakers, non-profits and financing providers as well.”

News item from EnergySage