The U.S. may only reach 25% to 38% of carbon emissions reductions below 2005 by 2030, falling well short of the 50% to 52% required by the agreement, said the Energy Information Administration.

A projection of the realistic may inspire some pessimistic feelings for readers of the Energy Information Administration’s (EIA) annual energy outlook report, which tracks broad changes in the United States energy mix.

The report highlighted that the United States is currently not on the path needed to meet the carbon emissions reduction targets set by the Paris Agreement and avoid the worst effects of climate change. The agreement calls for a 50% to 52% reduction of emissions below 2005 levels by 2030. Currently, EIA projects the U.S. is on a course for reducing it by 25% to 38%.

Notably, the Inflation Reduction Act (IRA) is expected to help the U.S. ramp up rapidly to meet the goal faster. The $369 billion climate and energy package in the IRA is expected to lead to a 33% reduction below 2005 levels by 2030, a far cry from the 50% reduction needed, but significantly greater than the 26% reduction EIA expected without the historic law. By 2050, EIA expects IRA to guide the U.S. to an additional 17% less carbon emissions versus last year’s pre-IRA projections.

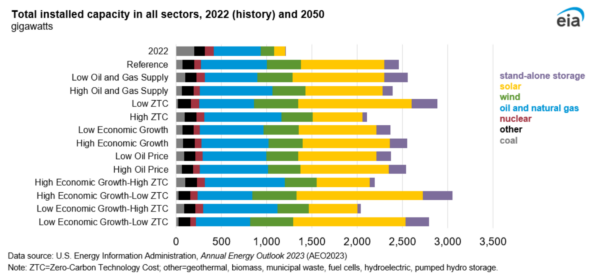

Renewable energy developers are rapidly raising capital, training workforces, and working to secure a steady supply of components to achieve these goals and serve steadily increasing electricity demand. Demand will be driven further by increased electrification of transportation, buildings, and industry. Total installed power capacity is expected to double by 2050 to meet this increased demand.

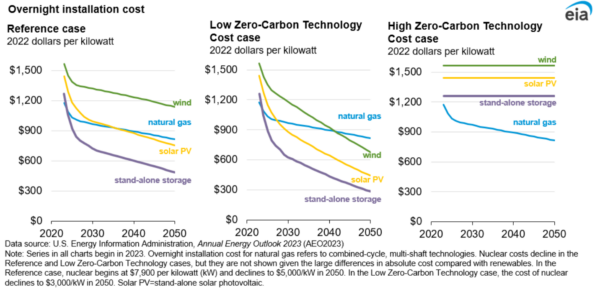

Once built and when the resource is available, wind and solar are the least cost resources to operate to meet electricity demand because they have zero fuel costs, said EIA. Thus, over time, the combined investment and operating cost advantage is expected to increase the share of zero-carbon electricity generation.

Post-IRA, projections for solar development are significantly higher, though the range is wide, as uncertainty around global supply chain constraints and grid interconnection costs and delays threaten to hamper growth.

“Across all cases, compared with 2022, solar generating capacity grows by about 325% to 1019% by 2050, and wind generating capacity grows by about 138% to 235%. We see growth in installed battery capacity in all cases to support this growth in renewables,” said EIA.

EIA projects a wide range of energy storage buildout. The reference case for 2050 estimates 160 GW of standalone battery storage capacity will be deployed, and deployment varies between 40 GW and 260 GW in the other cases.

Meanwhile, coal-fired electricity is expected to decline sharply by 2030, cutting its contribution in half from current levels by 2030. The IRA hastens the near-term decline of coal and speeds up retirements across the U.S. coal fleet, said EIA.

EIA also expects continued cost relief for solar, wind, energy storage, and natural gas. Solar is expected to be the lowest cost generation source in the EIA’s reference case, reaching between $600 per kilowatt and $900 per kilowatt by 2050 in 2022 dollars.

The EIA Annual Energy Outlook can be found here. The report includes downloadable data files, Excel sheets, interactable dashboards, and narrative reports on the Administration’s summary of today’s energy profile and the outlooks for 2030 and 2050.

Despite potential failures to reduce economy-wide emissions, the electricity sector is expected to make strides in emissions reductions by 2030. A Department of Energy and National Renewable Energy Laboratory analysis found that clean electricity as a percentage of total generation could increase to over 80% in 2030 under mid-case assumptions. The low-case and high-case projections place clean energy’s share of electricity generation between 71% to 90%. This is substantially greater than the 41% share emissions-free electricity achieved in 2022.

Under the model, solar and wind scale rapidly, more than doubling historical maximum rates of annual deployment in many scenarios. DOE now expects 350 GW to 750 GW of new capacity from these two technologies by 2030 depending on future market conditions.

This renewables growth is projected to be supported by 40 GW to 100 GW of new energy storage and a 11% to 24% expansion of long-distance transmission by 2030.

Furthermore, the DOE said clean electricity growth will lower bulk power costs by $50 billion to $115 billion through 2030, saving ratepayers money on their bills. In 2030, the reduction equates to approximately $3 per MWh (5%) to $6 per MWh (13%).

“The U.S. energy system is rapidly changing. In recent years, technology innovation has accelerated the deployment of renewable energy, expanded markets for electric vehicles, and established record-high levels of petroleum and natural gas production. Heightened geopolitical risks have also influenced the energy system. And this year, recent federal legislation authorizes historic levels of investment in clean energy technology,” wrote Joseph DeCardolis in a foreword to the Annual Energy Outlook.