Silicon Valley Bank, one of the nation’s largest, was closed by the FDIC on Thursday night after $42 billion in withdrawals occurred after a massive stock drop due to ongoing losses in the bond market.

Thursday night, Silicon Valley Bank (SVB) was put into receivership by the U.S. Federal Deposit Insurance Corporation (FDIC). As part of standard practice when a bank collapses, the FDIC created a new bank – the Deposit Insurance National Bank of Santa Clara – making available account deposits of up to $250,000.

Sunday evening, the U.S. Federal Reserve (Fed) announced that all deposits were going to be secured, and available to depositors on Monday morning. SVB has locations in California and Massachusetts.

The bank’s $209 billion in assets make it the second largest bank failure in U.S. history, and the 16th largest in the United States. The bank’s challenges, some of which were known, accelerated when it announced a sale of $21 billion in assets at a 9% loss in order to make sure it could still cover all assets.

This action led to multiple hyper-connected business groups to quickly withdraw $42 billion in assets. Amongst the leading groups pulling their capital was Peter Thiel’s Founder Fund. Reports of thousand-strong WhatsApp groups telling people to pull their cash circulated.

A second bank also collapsed, Signature Bank in New York, and was also being managed by the Fed in a similar manner as SVB.

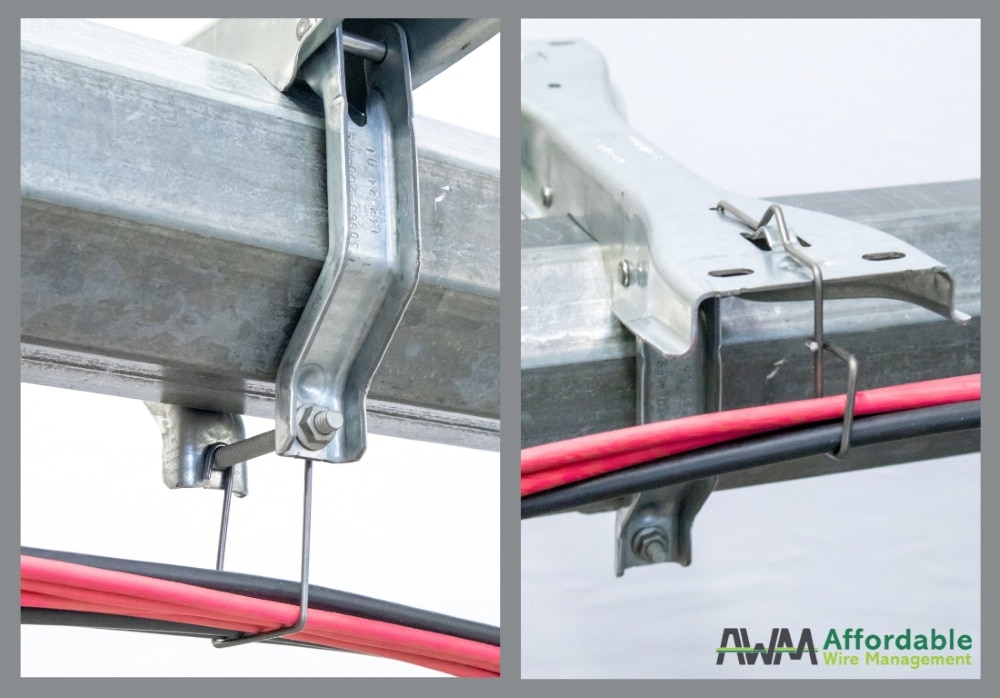

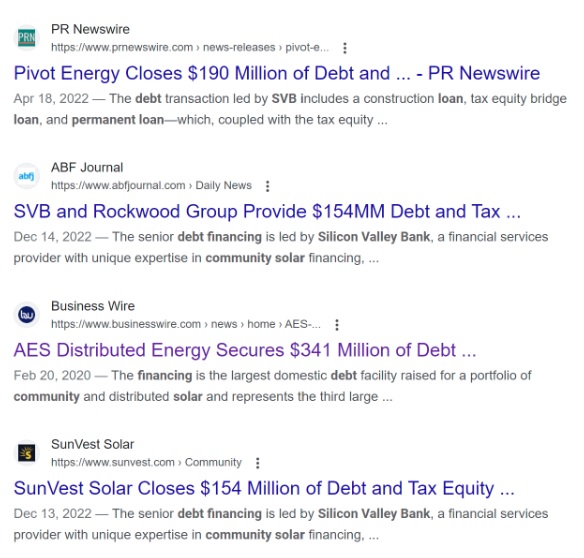

Solar development finance

The bank’s website stated they had a hand in financing 62% of community solar projects as of March 31, 2022. A Google search verifies a definite relationship.

pv magazine USA has reached out to multiple community solar involved companies to get their reactions to these events.

Industry reactions

Over the weekend, publicly-traded residential solar companies Sunrun, Sunnova Energy and others issued statements on SVB’s failure.

Sunrun said SVB was a lender on two of its credit facilities amongst many banks, but said SVB was less than 15% of its total hedging facilities. Sunrun does not anticipate significant exposure. Sunrun does hold cash deposits with SVB totaling nearly $80 million, however, the Fed has stated these are protected.

Sunnova stated its exposure to SVB was negligible because it does not hold cash deposits or securities with the financial group. However, one of its subsidiaries is part of a credit facility where SVB serves as a lender.

Stem, an energy storage development company, said it estimates less than 5% of cash deposits and short-term investments could be impacted by SVB’s closure, though the company holds no credit facilities with the bank.

Sunrun’s stock lost 12.4% in value since SVB’s collapse late last week, while Sunnova and Stem were down 11.4% and 10.4% respectively.

Other energy industry comments were made, mostly with little to effects announced.

On Sunday, before the Fed announcement, reports were circulating that hedge funds were offering to buy depositor accounts for 60% to 80% of their value. The report noted that the bids represented how much the “uninsured deposits will ultimately be recovered once the bank’s assets are sold or wound down”.

On March 9, a few days before the failure, Forbes announced that SVB was its 20th ranked bank on their annual list of America’s Best Banks.

First Republic Bank’s stock is massively down this Monday morning, March 13, 2023. As well, general markets are down, along with bank sector stocks.