The Solar Energy Loan Fund (SELF), a 501(c)(3) non-profit organization providing unsecured financing solutions to Florida and Southeast U.S. residents adding solar and home improvements, recently surpassed $30 million of cumulative loans.

As a green bank and Community Development Financial Institution (CDFI), to date SELF has provided loan products to historically underserved and underbanked low-to-moderate income (LMI) communities such as retirees, working class families, veterans, disabled homeowners and those with poor credit background.

SELF has issued more than 3,000 green home loans, which average about $10,000 per loan but can range up to $50,000, for rooftop solar, high efficiency air conditioners, roofing repairs and other residential sustainable improvements.

“SELF is an implementation tool to retrofit and build new resilient, affordable housing while fostering green jobs, energy equity, resilience, and clean energy for all,” said Doug Coward, executive director of SELF. “LMI homeowners are the most susceptible population to climate change, heat waves, and severe weather, and they have participated and benefited the least from the fast-emerging clean energy economy.”

Fort Pierce, Florida-based SELF was formed in 2010 with $3 million in seed grants from the Department of Energy. The non-profit prides itself as being the first local national green bank. In recent years SELF expanded outside of Florida into Georgia, South Carolina, Tennessee and Alabama, and has partnerships with the cities of Orlando, St. Petersburg and the Atlanta (Georgia) Housing Authority.

Unlike traditional banks, SELF knocks down traditional barriers by advancing financial inclusion and filling key gaps that have historically set back LMI communities from accessing small loans for home improvements, including solar.

SELF has two dozen investors, including crowdfunding platform, KIVA.org, while 900+ contractors throughout the Southeast are able to assist customers with loan accessibility through SELF. The non-profit has leveraged the original DOE grant by a 13:1 margin and provided financial assistance to more than 9,000 people.

Maria Duanne Andrade, chief financial officer of SELF, created the agency’s inclusive underwriting process based on the homeowner’s ability to repay the loan balance, rather than a credit score-based rating system. Its credit system enabled the launch of its flagship Green Home Loan program for LMI homeowners with less than 2% default rates.

“Green banks have the power to unlock economic, environmental, and social benefits, especially in underserved communities,” said Andrade. “Financial systems are overly reliant on credit scores, and traditional underwriting methods leave too many people behind.”

SELF-originated loans are primarily funded by either crowd-funding or a mix of local banks, impact funds and faith-based institutions such as churches.

SELF loan financial terms:

- Renewable Energy Projects: 8 to 9.5% APR with 5 to 10-year loan term

- Energy Efficiency Projects: 8 to 9.5% APR with 3 to 5-year term

- KIVA crowdfunded loans: 5% fixed interest with 3 to 5-year terms

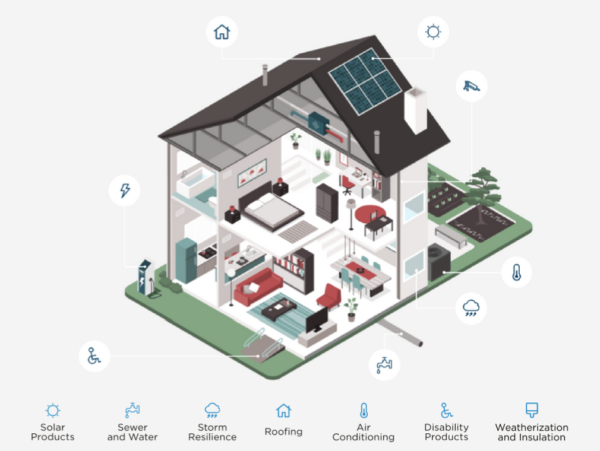

Residential projects eligible for financing include:

- Weatherization and insulation

- Replacement of inefficient air-conditioning systems

- Solar thermal and solar photovoltaic systems

- Roofs, windows, doors, and hurricane shutters

- disability products and aging in place

Green Bank meets Fintech

In recent years, SELF’s Andrade has put the loan originator into adjacent markets, providing green loan products to minorities, small building landlords and developers of affordable housing buildings, as well as a septic to sewer loan product.

Meanwhile, the organization has been pivoting to keep up with the emergence of financial technology applications that provide rapid access to small loan products. In December, SELF’s plug-and-play fintech platform received a $3 million grant from JP Morgan Chase in order to provide capital to minority and novice affordable housing developers.

According to EnergySage, other providers of secured and unsecured solar loans in Florida and the southeast region include Climate First Bank, Dividend Finance, Sungage, Sunlight Financial, Sunnova Energy, Mosaic, GreenSky Credit and EnerBank USA.

According to Wood Mackenzie, the solar loan market grew 37% from 2021 to 2022. Homeowners see the greatest monthly savings on 25-year loans, which also match a residential solar installation’s warranty period.

Interest in residential solar financing will continue to grow now that the Inflation Reduction Act (IRA) extended the solar investment tax credit at 30% for another 10 years.