U.S. Solar Market Insight Q4 2022 forecasts a 23% decline in solar installations.

The United States added 4.6 GW of new solar capacity in Q3 2022, a drop of 17% from the same quarter last year. According to the U.S. Solar market Insight Q4 2022 report, released today by the Solar Energy Industries Association and Wood Mackenzie, despite the best efforts of the Inflation Reduction Act (IRA, trade barriers and ongoing supply chain constraints are to blame for the decrease. The total drop for the year will be 23%, according to the report.

Detainments under the Uyghur Forced Labor Prevention Act (UFLPA) are depressing near-term solar installation forecasts and delaying the impact of the IRA, the report contends. UFLPA presumes that goods manufactured in the Xinjiang region of China are made with forced labor, and the onus is on the manufacturer to prove otherwise. The Act went into effect in June 2022, and resulted in U.S. Customs and Border Protection seizing and retaining more than 1,000 shipments of solar equipment. In August, ROTH Capital Partners said over 3 GW of components were held up at Customs. It estimated that much as nine to 12 GW of solar modules could be prevented from entering U.S. markets by the end of the year.

The U.S. Department of Commerce’s decision earlier this month to apply anti-circumvention tariffs on solar products from Southeast Asia risks future solar deployment, however the ruling was not taken into account in the outlook. The Commerce Department had thrown out an earlier request in 2021 by an anonymous group of solar companies seeking tariffs on a handful of companies that import modules, but then Auxin Solar (a small U.S.-based panel assembler) filed new round of antidumping/anti-circumvention (AD/CVD) cases against Malaysia, Thailand, and now Cambodia. In June 2022, the Biden Administration paused the issue with a 2-year tariff exemption. Now the threat is that after the 2-year pause, the tariffs will be back in play. Authors of the Wood Mackenzie/SEIA U.S. solar market insight note that while the AD/CVD ruling was not issued in time to be incorporated into the forecasts, they see new tariffs as a downside risk to the outlook.

“America’s clean energy economy hindered by its own trade actions,” said SEIA president and CEO Abigail Ross Hopper. “The solar and storage industry is acting decisively to build an ethical supply chain, but unnecessary supply bottlenecks and trade restrictions are preventing manufacturers from getting the equipment they need to invest in U.S. facilities. In the aftermath of the Inflation Reduction Act (IRA), we cannot afford to waste time tinkering with trade laws as the climate threat looms.”

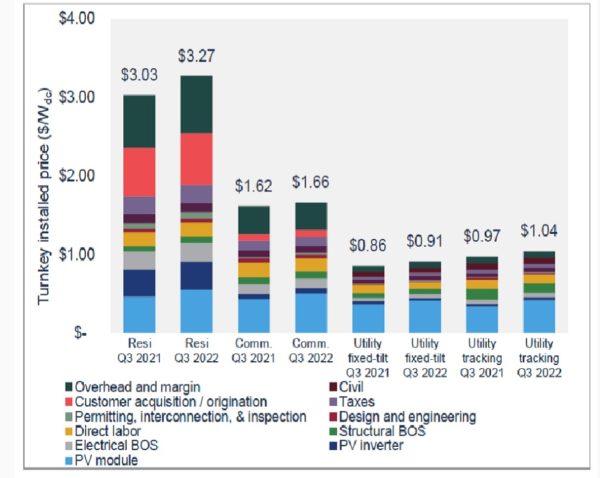

In addition to hampering the flow of goods to the U.S., the supply chain challenges have caused prices to escalate across the solar industry. For the fifth consecutive quarter, year-over-year prices have increased across all market segments. Utility-scale prices, for example, are 12.7% higher than they were a year ago. As a result, 2022 installation forecasts show deployment dropping from 30 GW to 15 GW over the last year.

“Installations this year were significantly depressed due to supply chain constraints” said Michelle Davis, principal analyst and lead author of the report. “It has proven more difficult and time-consuming to provide the proper evidence to comply with the UFLPA, further delaying equipment delivery to the U.S.”

There is good news, however. Solar accounted for 45% of all new electricity-generating capacity added to the U.S. grid, through the third quarter. The residential sector has not experienced a drop—in fact it saw a 43% increase over Q3 2021, with 1.57 GW installed. Some of this came from California, where residents scramble to get solar installed before net metering changes kick in. And overall, the report forecasts that growth, resulting from the IRA, will begin in 2024, with annual solar growth averaging 21% between 2023-2027.

Q2 2023 pivotal

Further good news is that the solar industry is expected to return to growth after 2022. Supply chain relief should arrive after Q2 2023, and at that point “the true impacts of the Inflation Reduction Act will manifest in our outlooks,” according to the report. Annual installations of solar will consistently reach 30 to 40 GWdc by 2024. From 2023-2027, the report forecasts 21% average annual growth across all solar segments, although report authors note that AD/CVD tariffs present a downside risk that will be included in future outlooks.