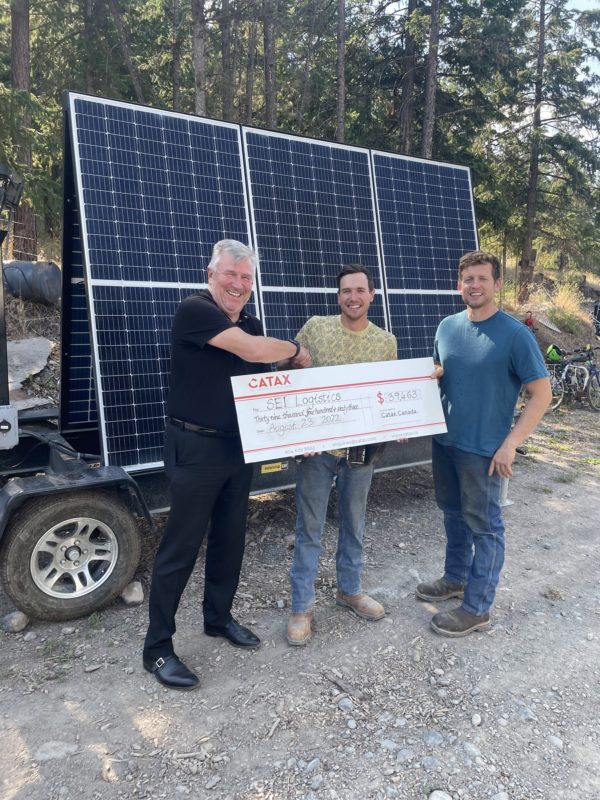

SEI Logistics secured nearly $40,000 in Canadian tax incentives for its portable, folding solar panels with batteries, designed to work in harsh and remote environments.

SEI Logistics’ portable, folding solar panels and battery solution are designed for use by the oil and gas industry, where off-grid power is needed in remote and extremely cold locations. The portable panels come with a battery housed in a case, specially designed for cold and harsh environments. The technology was recently awarded nearly $40,000 in tax incentives from the government of Canada.

While most batteries don’t perform well in permafrost areas, SEI found a manufacturer of military grade cases used for transporting and storing missiles, which the company uses for its batteries. The cases house the batteries as well as heaters to keep them warm.

SEI uses lithium-ion batteries with a positive temperature coefficient (PTC) heater. When the temperature outside drops, more of the power from the panels goes to the heater that warms the batteries, SEI reports.

The foldable module design of the solar panels was developed so that the off-grid solution could be easily transported and set up anywhere. According to SEI, technical challenges included how small and light the structure could become without compromising sturdiness and performance, and how to reduce the number of components without leaving panels vulnerable to high winds. After extensive experimentation, the designers realized that once new custom-designed hinges were used, bulky gas springs were no longer required, and that if they increased the panels’ proximity to the ground, they performed exactly the same in wind tunnel testing.

Canada has committed to reducing carbon emissions while safeguarding an economy that depends greatly on natural resources. The country recently released 2022 Fall Economic Statement, which introduced investment tax credits (ITC) for clean technologies and clean hydrogen that will help spur the transition to net-zero energy and make Canada more competitive with the United States. The clean-tech tax credits will be offered to those who invest in net-zero technologies, battery storage and clean hydrogen. The new 30% Canadian tax credit will apply to investments in renewable energy generation and storage, as well as in as low-carbon heating and zero-emission industrial vehicles. The Canadian government also plans a tax credit for hydrogen production, the design of which has yet to be determined.

“While the IRA will undoubtedly accelerate the ongoing transition to a net-zero North American economy, it also offers enormous financial supports to firms that locate their production in the United States – from electric vehicle battery production, to hydrogen, to biofuels, and beyond,” the government said in the economic update. “Without new measures to keep pace with the IRA, Canada risks being left behind.”

One of the primary sources of investment that the Government of Canada gives to businesses and organizations operating in this sector is the Scientific Research & Experimental Development (SR&ED) program. This tax incentive for innovation allows businesses to claim back expenses incurred on research and development (R&D) activity. This is made up of a combination of federal and provincial funding. Not every cost associated with R&D can be included in a claim, however, the main qualifying expenses include staff costs, salaries, materials, as well as payments to contractors and third parties.

“When you’re faced with overcoming challenges as great as these are, having access to this kind of funding is invaluable. Knowing we can rely on SR&ED has completely energized our whole approach to innovation. The benefits it brings mean we’re investing more in R&D than ever before,” said Eric Little, founder and CEO of SEI Logistics.