Mercom reports that equity financing and M&A transactions were both up more than 55% in 2022, as the energy transition draws new levels of investment.

In a report that tracks distributed energy technology funding for 2022, Mercom Capital Group reported that total equity, debt and public market financing hit $31.7 billion for the full year, with $26.4 billion in energy storage across 124 transactions representing a 55% year over year increase from 2021, with acquisition activity in the storage market also the highest since 2014.

Total corporate funding of $31.7 billion in 2022 was a 63% increase over 2021 at $19.5 billion, as global companies see the value in investing in the energy transition.

“Funding into energy storage continued to grow at record levels in 2022; however, some of the funding activity shifted from venture capital and private equity to public market and debt financing,” said Raj Prabhu, chief executive officer, Mercom Capital. “In addition to record funding activity, energy storage companies and projects were also acquired in record numbers, a reflection of maturity in energy storage markets and assets. The global energy transition, and the shift toward EVs, along with the Inflation Reduction Act, provided strong tailwinds for energy storage companies.”

Energy storage

Lithium-ion battery companies garnered the most funding in 2022, with battery recycling, iron-air, solid-state batteries, and energy storage systems trailing behind lithium batteries.

The largest venture capital (VC) deals for the year include Eolian ($925 million), Form Energy ($450 million), Group14 Technologies ($400 million), Ascend Elements ($300 million) and Hydrostor ($250 million).

Debt and public market financings for energy storage companies increased 151% with $20.6 billion worth of transactions compared to $8.2 billion raised in 2021. Six energy storage companies went public in 2022 compared to four in 2021.

Smart grid

Smart grid companies raised $3.3 billion in VC funding in 2022, a 175% increase from $1.2 billion raised in in 2021, representing the largest amount of VC since 2010. Including debt and public markets, total smart grid funding came to $4.7 billion for the year, a large increase from $2 billion raised in 2021.

The largest smart grid equity deals include TeraWatt Infrastructure ($1 billion), GridServe ($243 million), Arcadia ($200 million), Be.EV ($127 million) and Sense ($105 million).

Energy efficiency

Energy efficiency integrators and equipment suppliers banked $490 million in 2022 compared to $122 million in 2021.

The largest efficiency equity deals include Redaptive ($200 million), GridPoint ($75 million), OhmConnect ($55 million), and Elevation ($20 million).

In 2022, debt and public market deals by energy efficiency companies decreased with $50 million in one deal compared to $343 million from a single deal in 2021.

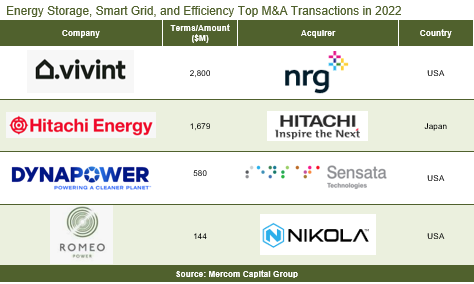

The largest M&A transactions for the year were NRG Energy’s takeout of Vivint, Inc., for $2.8 billion, followed by Hitachi’s acquisition of ABB’s 19.9% stake in the Hitachi Energy joint venture for $1.68 billion, and DynaPower, a maker of energy storage and power converters, acquired by Sensata Technologies for $580 million.